Santa Delivers an Early Christmas Gift

by Shelly Appleton-Benko | December 5, 2012

Effective January 1, 2013, your Tax-Free Savings Account contribution limit will increase to $5,500 per year. Residents of Canada who have reached the age of majority can contribute funds to their Tax-Free Savings Account (TFSA) throughout the calendar year and these funds remain tax-free for their lifetime.

If you have made a withdrawal from your TFSA, remember that you can top up your unused TFSA room as well as put back the funds you have withdrawn. All income earned and withdrawals from the TFSA accounts are tax-free and are a great way to achieve short and long-term savings goals. These accounts can hold most types of investment vehicles and are a great way to shelter future capital gains.

Odlum Brown includes TFSA accounts in our registered account package so that our clients can enjoy these accounts with no annual fee if you currently hold your RRSP with us. Consider adding a monthly contribution to your renewed budget plans for January and take advantage of this great savings tool.

Lunch & Learn Wednesday, November 21, 2012

by Shelly Appleton-Benko

Join us for an exclusive presentation with Murray Leith.

Odlum Brown’s Vice President and Director of Investment Research, Murray Leith, will share his thoughts on the economy and a few of his favorite equity ideas during this Lunch & Learn.

Making a List, Checking it Twice

by Shelly Appleton-Benko | November 15, 2012

Before you begin the daunting task of making a Christmas gift list, consider making a list to finish off the tax year right. Now is the time to top up those charitable donations, clean up your portfolios with tax-loss selling, contribute to your children’s RESPs and organize those pesky medical expenses.

First, if you are planning to make a donation to your favourite charity, consider donating a publicly-traded security. This strategy will provide a tax credit equal to the value of the stock donated, while potentially eliminating any capital gains tax accrued to you. All donations have to be completed by December 31, 2012 for the tax credit to help you this year.

Next, release the hounds! Clean up your portfolio and consider selling those investments that just aren’t working. This can help you offset capital gains realized earlier in the year to reduce your overall tax bill.

Education is expensive! Your children will appreciate your forward thinking if you make a contribution to their Registered Education Savings Plan. For those who qualify, contribute $2,500 and the government will kick in an additional 20 per cent of the amount that you make through the Canadian Education Savings Grant. It is like an instant return on your investment!

And last but not least, don’t forget those receipts collecting at the corner of your desk! Medical expenses that are not fully covered by your extended health plan can add up. It is prudent to collect them all from the past year and ensure that you are claiming eligible medical expense credits. Every last dollar makes a difference when tax time comes around.

So before you move on to the gift list and party planning, take a closer look and see if any of these year-end strategies may make a difference for you and your family. Give us a call if you have any questions.

Winner, Winner, Chicken Dinner!

by Shelly Appleton-Benko | November 6, 2012

Does it matter to you who will win the U.S. presidential race? Let me rephrase that: does it matter to your investments who will win the race? The answer is twofold.

Both parties have significant work to do the day after they take office (see "Fiscal Cliff") and either party will have to find the money to pay the nation’s bills. Economic growth in the world is hard to come by right now, but that doesn’t mean that your portfolio isn’t growing. There are opportunities in every market cycle and if you aren’t taking advantage of active portfolio management, then you may be missing out.

Paralyzed by Sandy

by Shelly Appleton-Benko | October 30, 2012

Overwhelmed by the weather, the NYSE made the rare decision to temporarily close its doors. Concern for employee safety and the Exchanges unproven electronic trading system were cited as the rational for its closure. The first time the exchange closed its doors for bad weather was in 1985, for Hurricane Gloria. The NYSE hasn’t been closed for two consecutive days since 1888.

Not only has the wrath of the storm closed the NYSE, but it has delayed earning results and conference calls. It has also put a damper on volume of trading on the TSX.

At the time of writing, the NYSE plans to be back up and running for Wednesday October 31, 2012. It may be a limited reopening, but a critical move nonetheless, as it is the primary exchange for so many blue-chip companies. (Yet another reminder of the industry’s disaster preparedness and importance of a business continuity plan!)

We send our best wishes to our clients and those with family affected by the storm.

Black Monday – Where were you 25 years ago today?

by Shelly Appleton-Benko | October 22, 2012

October 19, 1987 was the phenomenal day in the markets when the bull run of the late 1980s was brought to an abrupt crashing halt, affectionately referred to as Black Monday. Perhaps you recall exactly where you were or what you were doing on this eventful day in history.

While the world didn’t end on October 19, 1987, January 1, 2000 or March 8, 2009 (although all these days seemed dark in the investment world), we realize that these types of events are learning opportunities.

Our team at Odlum Brown doesn’t try to time the market cycles. Although macroeconomics is important and relevant, we believe in owning companies that will continue to thrive no matter what pitch is thrown their way.

This year started off with trembling optimism and we continue to muddle through the news of European Union woes, low interest rates, and troubling growth rates worldwide. The good news is that the stock market is a forward-looking market indicator and it has been telling us that the world markets are looking up and posting positive returns, some in the double-digit territory year-to-date.

So before you pick up the wine glass at the cocktail party and start talking about the woes of the stock market, remember that 2012 has been a positive year so far despite all the headlines. Cycles come and go and there will always be newsworthy events that lead to market declines, but at the end of the day when all the lights are off, you should be able to close your eyes and feel confident about the companies in which you invest. We believe the portfolios we build for our clients are of the best quality. In doing what’s best for our clients, we hope they will be able to rest easier. Know that we have our clients’ best interest in mind - ALWAYS.

The Fiscal Cliff - An Overblown Concern

by Shelly Appleton-Benko | October 17, 2012

In a recent Market Comment, Murray Leith, Vice President, Director, Investment Research, addressed investors’ concern regarding the “fiscal cliff” – a term coined by Ben Bernanke, Chairman of the U.S. Federal Reserve back in February 2012.

“The "fiscal cliff" is the media-hyped term used to describe the tax increases and spending cuts that are scheduled, by law, to hit the U.S. economy in the New Year. It is a major worry among investors that is regularly cited as a reason to be negative on the outlook for the economy and stock market. While it is a legitimate concern, we don't think it is a reason to abandon equities, and, in particular, the very high quality U.S. stocks we are recommending.”

Read Murray Leith’s rational, including his six reasons not to be concerned, here: The Fiscal Cliff - An Overblown Concern

A Picture Worth Sharing

by Shelly Appleton-Benko | October 9, 2012

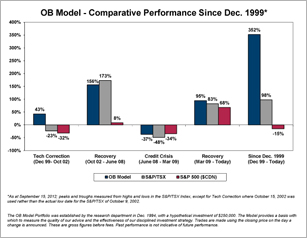

Many of you may be familiar with the Odlum Brown Model Portfolio. The Model provides a basis with which to measure the quality of our research advice and the effectiveness of our disciplined investment strategy. This hypothetical, all-equity portfolio was established in December 1994 and typically has 40-50 stock positions. It is well diversified across economic sectors, with an emphasis on high quality companies that have sustainable competitive advantages, conservative financial leverage and strong management. The Model holds foreign securities when good value or ample diversification is difficult to find in Canada.

Murray Leith, Vice President and Director of Investment Research, recently updated a chart showing the relative performance of the OB Model Portfolio through the major market corrections since 1999. Here were some of his comments regarding the chart:

"We knew that we weathered the technology storm very well and the 2008/09 financial crisis reasonably well (at least relative to our benchmark), but what came as a surprise was how good the cumulative result compared to the market. Since the end of 1999, the Model has appreciated by 352 per cent, 3.5 times as much at the 98 per cent advance in the S&P/TSX Total Return Index. By not losing money during the Tech Correction and by losing less during the Credit Crisis, we had a lot of money to put to work during the ensuing recoveries, such that our compound annual return over the entire period is quite satisfactory."

As highlighted in the chart below, the Odlum Brown Model Portfolio has achieved notable success since its inception:

(+ click the image to enlarge)

A Season of Gratitude

by Shelly Appleton-Benko | October 5, 2012

Thanksgiving is a good time to pause and reflect on everything and everyone for which and whom we are grateful. We wanted to take this opportunity to thank our clients, friends of the firm, and network of professionals for their business, support and referrals over the years.

As a token of our gratitude, we have made a donation to Free the Children’s - Adopt a Village. Free the Children works alongside the men, women and children in eight countries, who strive every day to free themselves from poverty, exploitation, disease and thirst. This effort is about empowering communities to break the cycle of poverty and support themselves over the long term. Happy Thanksgiving! We wish you and your families an abundance of peace this holiday season and throughout the coming year.

Lunch & Learn on October 24, 2012

by Shelly Appleton-Benko | October 3, 2012

We are pleased to offer a special presentation titled Estate Planning Update – How Recent Changes May Apply to You and Your Family (including the new Power of Attorney Act, Family Law Act and Wills, Estates and Succession Act).

Did you know that:

- New legislation will change the revocation of wills and beneficiary designations?

- New powers of attorney have different execution requirements, limitations and powers?

- New legislation coming into effect March 18, 2013 will change the division of family property in marriage breakdown as well as the effect of marriage and cohabitation agreements?

Emma A. McArthur, Associate, Wealth Preservation at Bull Housser, will be in our office for a “Lunch & Learn” presentation. Emma will provide an overview of some of the key changes and how they may relate to your personal situation.

Thank you to Our Everyday Heroes

by Shelly Appleton-Benko | September 11, 2012

I grew up in a family with a long history of serving the community, be it the military, RCMP, or health services. We have clients who are veterans, police officers, firefighters, and ambulance attendants. These men and women have devoted their lives to helping others in need and so often their efforts go above and beyond to make our communities better.

A few of us had the opportunity to attend the 2012 Surrey Mayor’s Ball in support of the Surrey Fire Fighter’s Charitable Society. It was a wonderful evening, benefitting a number of worthy causes including Sophie’s Place Child Advocacy Centre, the newest program under the umbrella of the Centre for Child Development; Surrey Adopt a Family; and the Burn Survivor Camp.

What a tremendous example of how a community can come together to ensure local charities are supported. A special thank you to everyone who donates their time, commitment and financial resources to making the communities we live and work in, even better places to live.

Best,

Shelly

Start teaching your kids about money… today

by Shelly Appleton-Benko | September 4, 2012

Yes, school starts this week and your children will sport new clothes and haircuts. While a new assortment of educators will begin to instruct your kids on reading, writing and arithmetic, they may not teach them about money. Likely, that will fall under your role as a parent.

Look at life as one enormous classroom. Every purchase you make is an opportunity for your children to learn how money is earned, spent and invested. Young people need to learn that cash and debit machines don’t have an endless supply, not every person receives a monthly pension cheque and ideally purchases made on credit should be paid off in full each month.

It is never too late to start talking about money. Keep it simple and deliver a consistent message. For younger children, consider using “Spend”, “Save”, “Invest” and “Donate” jars as a simple way to teach them the value of money and get them to model great habits. For teens, help them learn the difference between a need and a want. The next time they ask to purchase something, put away your wallet and instead help your young adult set a goal to save for a future purchase. It’s a great way for them to learn to budget and save.

If we criticize the youth of today about their spending habits without teaching our children about money, we have no one but ourselves to blame for the consequences.

Shelly

Summer Days

by Shelly Appleton-Benko | August 14, 2012

“Someone's sitting in the shade today because someone planted a tree a long time ago.”

— Warren Buffett

Enjoy the remaining days of summer!

Shelly

Performance Enhancers

by Shelly Appleton-Benko | August 7, 2012

How is it possible that a 140 pound, 5’4” woman can swim faster than a 195 pound, 6’4” tall man? Some rumours allude to performance enhancing drugs. As the story develops, various media sources state that it may be years before tests are developed to identify the latest and greatest performance enhancing drugs. Unfortunately, the memory grows dimmer with time as does the controversy.

Some portfolio managers also try and enhance portfolio returns using various performance enhancers, and promise to reduce risk and always keep your capital above water. The truth of the matter is that there is no magic formula to outperform the market. Strong performance is a result of great stock selection balanced with a suitable fixed income portfolio. There are new products in the marketplace that promise capital guarantees and above average returns; these are simply too good to be true. The fees charged to maintain these products are higher than normal as they involve derivative trading and/or insurance products.

Our message remains parallel with the top performing athletes around the world, solid and consistent investing over time will provide the foundation for outstanding returns. Perseverance and patience will prevail and we are continually committed to finding opportunities for our clients to add value to their positions. Enjoy the spirit of the Olympics!

Shelly

What to Leave the Kids

by Shelly Appleton-Benko | July 24, 2012

Warren Buffett, the man who really needs no introduction – business guru, investor extraordinaire, billionaire, Oracle of Omaha, Chairman and CEO of Berkshire Hathaway, the list of adjectives goes on and on – once said, “I want to give my kids enough so that they could feel that they could do anything, but not so much that they could do nothing.”

Wouldn’t it be great to know exactly how long we are going to live and the exact amount of money we are going to need to cover all of our lifetime expenses? Then we’d know exactly how much we had, if any, to leave to the next generation or our favourite charity. Life would seem that much easier, right?

Well, even if we did know this exact amount, distributing the estate is often more complicated. There are so many factors to consider and it can end up being an emotionally-charged task. Who gets what, and why, can cause family stress and turmoil.

There are many aspects of your estate to consider and the thought of planning can be overwhelming. It doesn’t have to be. We work closely with the specialists at Odlum Brown Financial Services Limited to help you prioritize issues. We also work with your other professionals to ensure your wishes are respected. With the lull of the summer, it’s a great time to get things started.

Seeing is Believing

by Shelly Appleton-Benko | July 11, 2012

The media is a powerful tool – one that is meant to stir the emotion of its audience. In June, there was much fuss about the European debt crisis and the markets were responding in a negative way each and every day.

On June 21st, I travelled to Italy to see and experience firsthand the mood and feelings of the general public. Back in 2009, during the North American debt crisis, the local mood was dull, people seemed depressed, stores were closed and the restaurants and malls were empty.

Conversely now in Europe, the tourist season has begun. People are ordering champagne by the pool, the streets are busy, and tours for attractions are sold out. Is there a crisis? Are we in panic mode? Who won the football match?

On a serious note, there is no doubt that the economics of the debt crisis will take time to work itself out. We will all have to tighten our belts and manage our expectations for investment returns. Europeans will come to realize that they have to pay higher income tax and countries will need to be more fiscally responsible than ever before. However, as the Europeans have quickly figured out, the world is not coming to an end and there is opportunity in every situation. As the saying goes, “Rome wasn't built in a day,” and the same is true for the market recovery.

Yes these are certainly tough times, but time heals all wounds and there will be a recovery – it is just a matter of time. In the meanwhile, we are monitoring our clients’ portfolios to ensure that they are ready for the rebound and we are confident that we will see the results.

Income Tax Submitted – Now What?

by Shelly Appleton-Benko | June 26, 2012

Every year after Canada Revenue Agency has received your income tax return, they send you a Notice of Assessment (NOA). The Notice of Assessment contains some important information including whether any changes have been made to your filing as well as your tax refund or amount owing. Now, before filing your NOA away for next year, there are a couple of details listed that will be helpful with your wealth planning for the year.

First, your RRSP deduction limited is listed. This limit represents the maximum that you can contribute to your RRSP less any unused RRSP contributions you may have accumulated. In addition, it also shows your TFSA contributions, withdrawals and unused contribution room (up to December 31 of the previous year). If you have participated in the Home Buyer’s Plan or Lifelong Learning Plan, you may also need to record the amount that needs to be repaid to your RRSP account. Respecting your limits is important as over-contributions can be complicated and cause Revenue Canada to penalize you!

Secondly, your NOA lists unused capital losses from previous years. This information will assist us in taking advantage of gains in your accounts without incurring further tax liability.

If you received a refund, let’s get those dollars working most effectively for you. This may mean paying down debt, perhaps your mortgage, or making a contribution to your RRSP or TFSA. Send us your NOA and we can get your game plan going!

Best, Shelly

MJT Odlum Brown Classic – PGA of BC Junior Championship

June 26, 2012

Odlum Brown lends its support for the 7th year as Tournament Partner of the 10th annual MJT Odlum Brown Classic – PGA of BC Junior Championship at Northview Golf & Country Club. The tournament, which draws top golfers from across the province, is endorsed by the British Columbia Golf Association and eligible top finishers receive exemptions into the BC Bantam, Juvenile and Junior Championships.

STM Wealth Management of Odlum Brown Limited is pleased to host an on-site hospitality tent at the tournament. We have also arranged for parents and spectators to hear from highly sought-after trainer, Jason Glass, Canada's top Golf Strength & Conditioning Specialist and regular guest on the Golf Channel. Jason will share his insights on “Preparing for your Best Performance,” a 30 minute talk about successful pre-game habits. The event will be held on-site July 4th at 11am. Please stop by our hospitality tent if you are interested in attending as space is limited.

What does my advisor really do?

by Shelly Appleton-Benko | June 13, 2012

Okay, so you have an advisor…admittedly, you may not really understand all that they do. You may be asking yourself: Do they just buy and sell investments? RRSPs? How does this really make a difference to me and my wealth plan? What exactly am I paying for?

A trusted wealth professional does much more than just choose the investments that are held within your accounts. Although active investment management is the cornerstone of any financial plan, we like to think of ourselves as the coaches of your professional advisory team. This team, like any other team, needs direction and coordination in order to provide you with a game plan to keep your financial affairs in working order. This plan allows you to effectively maximize the benefits of tax minimization, estate planning, business succession and overall risk management.

Most of our clients have started to make the leap to ensure all their professional advisors are speaking to each other and working together to keep them on the path to the championship. If you haven’t made the leap, can’t find the time or, need that extra boost from someone to get started, know that STM Wealth Management can help you with more than just managing your investments! Developing your strategic game plan today will help to position your portfolio for victory tomorrow.

Best, Shelly

Investing in Our Communities

by Shelly Appleton-Benko | June 1, 2012

Community involvement is a foundation of community growth and an integral part of our corporate responsibility. Odlum Brown has had a long history of sponsoring many community initiatives. The firm remains a proud supporter of the arts in the Lower Mainland – the Harmony Arts Festival, MusicFest Vancouver and Vancouver Opera to name a few.

For the third year, we have also supported the community of Lion’s Bay through their Arts Council events. Last weekend, they held the 2012 Art and Garden Festival. The nine beautiful gardens, each presenting the unique works of Lion’s Bay artists, were such a lovely way to showcase and integrate arts into the community. Congratulations to all those who were involved in the planning of the event!

As the arts are such an important part of a community, be sure to take time to stop and smell the roses, and enjoy the everyday art around you!

Best, Shelly

The Importance of Sound Advice

by Shelly Appleton-Benko | May 22, 2012

What beautiful weather we’ve been having in Vancouver! We were out on the golf course last week with some of Odlum Brown’s Research Analysts and friends of the firm to get some pointers on how to improve our game.

We had the opportunity to work with Matt Palsenbarg, PGA of Canada, who is the Director of Instruction at Northview Golf Academy and the Tour Performance Lab. While listening to Matt’s techniques, I couldn’t help but draw the parallels between his role as a golf coach and our role as a wealth coach – and the importance of sound advice.

Investing is like golf, you need to have a strategy for your short game and your long game. Your strategy will need to be re-adjusted from time-to-time to account for changes in conditions. A coach can identify the (sometimes) small changes that can make a big difference. Discipline, commitment, intuition and strategy all play a part in your success.

As your wealth coaches, we’ll take care of these strategies and your portfolio, so you can enjoy the links!

Best, Shelly

Globe and Mail Coverage!

by Shelly Appleton-Benko | May 16, 2012

For those readers who may not be as familiar with Odlum Brown's investment style, this weekend's article by Rob Carrick in the Globe and Mail provides some insight from Murray Leith, Vice President and Director, Investment Research. This article demonstrates the impact of Odlum Brown’s investment style and the difference our approach can make on your portfolio.

Here is the link to the article, “Beware the limitations of buying the index,” and the chart (a great visual!) that accompanies the story.

Enjoy the read.

Shelly

The Birds, the Bees and Maggie de Vries

by Shelly Appleton-Benko | May 9, 2012

Ever since I was a little girl, I have always loved to read. Reflecting on it now, it is so relevant for the work that we do – keeping up on current market trends, learning successful leadership strategies and understanding where companies are heading. I simply love to read and have tried to encourage my own children to learn through books.

Last week, we had the chance to bring together a class of wide-eyed children to hear from award-winning author, Maggie de Vries. Maggie provided a sneak peek of her soon-to-be released work, Big City Bees (published by Greystone Books), and an inspiring talk about her journey as an author.

All I can say is, what a day! The children had the opportunity to hear firsthand how the story came to be, including an on-site visit of the bee boxes at the Fairmont Waterfront Hotel – one of the settings in the book. They learned some cool facts about bees and had a chance to sample the honey produced at the hotel too.

Everyone should take the time to learn something new through the eyes of a child. You just never know what you might see that may change your overall outlook.

A special thanks to the Fairmont Waterfront and to Maggie for a fabulous event! Be on the lookout for Maggie’s book in the fall.

Here are a few photos of the fun day.

(+ click the image to enlarge)

Best, Shelly

Spring has Sprung

by Shelly Appleton-Benko | May 3, 2012

It might be time to do some spring cleaning in your portfolio! Re-evaluate your holdings and consider consolidating your investments into vehicles that will better assist you in reaching your financial objectives. The old investment saying of “sell in May and go away” can sometimes prove to be very fruitful if there is something dragging down the performance of your portfolio, or if there are better opportunities to upgrade the quality of your holdings. Much like the reward of cleaning out your closet, life will seem simpler.

Sometimes the hardest part is getting started. We take a pro-active approach in managing our clients’ portfolios. Give us a call to make the spring cleaning of your investment closet a bit easier for you and your family.

Best, Shelly

The Only Thing Constant is Change

by Shelly Appleton-Benko | Apr 17, 2012

Thanks to Odlum Brown Financial Services Limited for providing the information below on the changes to OAS announced in the 2012 Federal Budget.

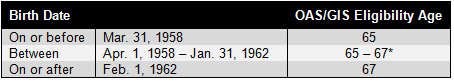

The 2012 federal budget introduced a number of measures targeting social and retirement programs. Among these measures are the widely publicized changes to the Old Age Security (OAS) and Guaranteed Income Supplement (GIS) eligibility ages.

The budget proposes to increase the age of eligibility for OAS and GIS benefits from age 65 to 67 as follows:

*A detailed breakdown of OAS and GIS eligibility by date of birth can be found on the Department of Finance website.

This change will start in April 2023, with full implementation by January 2029, and will not affect anyone who is 54 years of age or older as of March 31, 2012.

The budget also proposes to allow for the voluntary deferral of the OAS pension, by up to five years, starting on July 1, 2013. Similar to the Canada Pension Plan (CPP), this option would allow pensioners to defer their OAS pension and receive a higher monthly amount.

Odlum Brown Financial Services Limited will provide a summary of the proposed measures in the May 2012 OB Report. Stay tuned.

For Generations

by Shelly Appleton-Benko | Apr 10, 2012

We are passionate about what we do and we love working with so many great clients. We help generations of families with their unique wealth needs across all stages of life.

Recently, one of our clients welcomed a new little boy into the world—the joy and promise of what a new life brings is immeasurable! Why am I writing about this new little guy? He will be a fourth generation client—his Great Grandma, Grandparents, and Parents are our clients—soon we will help his family set the foundation for his financial future.

We are here to help with every step of your investment journey. Let us know if your family can benefit from our wealth management services too.

Congrats to all and welcome baby Matthew.

Best, Shelly

Tax Pain?

by Shelly Appleton-Benko | Mar 30, 2012

April 30, 2012 is just around the corner which means that personal income tax filing is due! While waiting for the last of your tax slips to arrive, it is wise to gather other information you will need for any deductions and credits that you may be eligible to claim.

There were a few changes introduced in 2011 that might be applicable to your situation including a new Children’s Art Tax Credit, changes to the Medical Expenses Tax Credit, Exam Fees towards a professional designation, and the Volunteer Firefighter Tax Credit. Don’t forget about pension income splitting and the Children’s Fitness Tax Credit, which were previously introduced. Be sure to check with your tax professional to ensure you are using them to your advantage. We would be happy to work with your accountant to ensure that your strategic wealth plan is in place and that your tax pain is reduced as much as possible!

Best, Shelly

Check It Out

by Shelly Appleton-Benko | Mar 20, 2012

Odlum Brown recently held its signature event, the Annual Address featuring Debra Hewson, President and CEO; Murray Leith, Vice President and Director, Investment Research; and Hank Cunningham, Fixed Income Strategist.

I invite you to watch the videos and hear their thoughts on the economy and the year ahead. Murray's presentation is approximately 25 minutes, and we've received some great feedback saying that it is worth watching. Here is the link for those of you who may be interested. Enjoy!

Best, Shelly

Did you do it again?

by Shelly Appleton-Benko | Mar 13, 2012

Did you make that last minute RRSP contribution to ensure you didn't have to write a cheque to the CRA? Stop the yearly panic and get on board to contribute to your account monthly. It’s easy, just ask us how. It is often said that the number one strategy for a wealthy retirement is to pay yourself first. Remember, David Chilton’s book was the Wealthy Barber not The Procrastinator.

Best, Shelly

ASAP

by Shelly Appleton-Benko | Feb 24, 2012

I thought it would be fruitful to show how powerful an RRSP contribution can be. Differences and disclaimers aside, always consult with your professional advisors on your situation before making any bold moves.

But really, let’s do the math.

Assuming you are a BC resident and your earned income for the year is $100,000, your combined Federal and BC marginal tax rate is 38.29 per cent. If you made a $17,000 contribution, you would now “deduct” this amount from your $100,000, moving you to a lower taxable income of $83,000 ($100,000-$17,000) and, as such, reducing your marginal tax rate to 32.50 per cent. This translates into tax savings or deferrals of approximately $6,377.

Let your money work for you, not the government. Don’t forget that the $17,000 gets added to your RRSP, so the funds stay in your hands and you may be writing a smaller cheque to the government on April 30 (or ideally no cheque at all).

Why you should contribute to your RRSP comes down to simple math and yet so many folks don’t do it. The RRSP deadline is Feb. 29. Don’t delay, call me today.

Best, Shelly

Steady Climb

by Shelly Appleton-Benko | Feb 14, 2012

The power of compounded returns is almost immeasurable. Many investors continually chase the big win, the lottery ticket, the next iPhone discovery in hopes that their investments will grow overnight and fulfill all their dreams.

We must remember that old parable about the tortoise and the hare. Who won the race? The power of those dull and boring five per cent annual returns just may be the answer to all your lifetime dreams. Make an RRSP contribution by February 29, 2012 or top off your Tax Free Savings Account and resist, resist, resist that new couch. It will still be there when you get your tax return in April.

Best, Shelly

Letting Go

by Shelly Appleton-Benko | Jan 30, 2012

Regular portfolio reviews play an important part in our service offering. When we review accounts, we take many factors into consideration – individual holdings, asset allocation, diversification, risk tolerance, time horizon, income and growth needs, market conditions, and the list goes on!

There are times, when we come across a position that just hasn’t worked out the way we anticipated. Our challenge is whether we continue to hold on to the position for a possible recovery, buy more to average down, or ‘simply’ take a loss and sell the position.

Yes, we acknowledge that there are considerations including tax consequences and the return of capital that need to be part of the decision, but we need to ask ourselves: Would we buy the stock today as a new position? If we wouldn’t, then we should consider letting go of something that is no longer working. It’s a difficult decision to make, but if the position is no longer working and/or confidence is lost in the company it might be best to clean house and move on to greener pastures.

Best, Shelly

Partnerships that Matter

by Shelly Appleton-Benko | Jan 18, 2012

In Wealth Management news, we continue to reiterate the importance of working together with all of your professional advisory team members, enhancing those relationships in order to ensure your family is well taken care of in all aspects of your wealth strategy.

You may be wondering, where should I start? Give us a call and we can take the next steps to work with your accountant. We often see good tax preparation and filing, but not enough coordinated planning for tax reduction and wealth transfer among the generations.

Many of our clients choose to “conference us in” during the meeting with their accountant, so together, we can discuss and address any investment issues that may be of concern. While tax time is still a few months away, typically, your accountant’s time in March and April is at a premium. You may find that a January or February call or appointment yields more efficient and thorough results. Working with you and your other professional advisors are part of the services we offer our clients, so feel free to give us a call and ensure that no money saving opportunities are overlooked!

Did you know? Electronic tax records are available on-line for our clients. This may ease the burden on accountants with regards to lost slips and mail delays. It may also provide your accountant more time for the planning process with you. If you are interested in signing up for this on-line service, send me an e-mail.

With you every step of the way.

Best, Shelly

A New Year with New Beginnings

by Shelly Appleton-Benko | Jan 10, 2012

Thank goodness 2011 is over! Let’s hope that 2012 brings with it a renewed concentration on repairing the economy.

Just as the U.S. economy rebounded in 2009, the European Union (EU) needs time to heal. In early March, we can expect some concrete plans from the EU on their debt reduction strategy, and, hopefully, the market will see this as a step in the right direction.

In the meantime, we need to ensure that portfolios are positioned in quality investments while we await the recovery. While it may be hard to imagine, the stock market cycle will eventually revert back to positive growth territory. With this in mind, there are many good quality companies available at very attractive prices to further enhance equity positions. Opportunities always exist and we continually search out those that fit our clients’ needs.

On the fixed income side, we have seen a significant transformation over the last few months in our clients’ portfolios, as a number of corporations have started to repurchase their bonds prior to the set maturity date (early redemption). As well, overall bond yields and availability have been at an all-time low. Credible replacement alternatives continue to be large-cap, blue chip stocks with strong dividend histories or preferred share investments.

It is a new year with new beginnings, so this is a good opportunity for you to establish your new (or renewed!) strategic wealth management plan. Let’s get started.

Best, Shelly