Countdown to College

by Shelly Appleton-Benko | November 27, 2017

Whether your child or grandchild is five months, five years or 15 years, thoughts of their future self are inevitable. It may lead you to thoughts of their post-secondary education and the potential worry of how to afford it. According to the Government of Canada website, the cost of a four-year program can be more than $66,000! Here are a few planning considerations that may ease that stress.

New baby – 18 years until college

If your personal circumstances allow it, consider setting up a preauthorized deposit directly to your child or grandchild’s Registered Education Savings Plan (RESP). Those smaller monthly contributions will add up over the years and benefit from compound interest. A $65 monthly contribution over 18 years earning 5% interest can add up to $22,000 (receive more with the Canada Education Savings Grant). If you receive the Canada Child Benefit, consider the long-term benefits of depositing it into the RESP. This can be a great starting point to help you reach your savings goals.

Age 5-6 – 12-13 years until college

Although your child is young, start with some simple lessons on the value of money. On birthdays, holidays or other celebrations, consider depositing gifted funds into the RESP as well.

Age 14-15 – 3-4 years until college

Is your child ready for a part-time job? Mowing lawn in the summers or refereeing for their local sports team might be an option. Encourage them to save a portion of their earnings to help fund post-secondary education.

Talk to your child about their future career aspirations. What are the steps they’d need to take to get there? Could it be a trade school, college or university? Will it be local or abroad? Have them start to consider, and maybe even research, what their future might look.

Age 16-17 – 1-2 years until college

How is your child doing academically? Perhaps they excel in sports or the arts or actively volunteer. Will they be eligible for any scholarships? Encourage them to learn what opportunities are available to them.

No matter what your child or grandchild’s age, there are steps that you can take to help relieve the financial burden once the time for post-secondary education arrives. As Winston Churchill said, “Saving is a fine thing. Especially when your parents have done it for you.”

Driverless Cars and the Road Ahead

by Shelly Appleton-Benko | November 1, 2017

Autonomous vehicles seem to be the hot topic lately. Companies are spending a lot of money and brain power trying to be the dominant player in this evolving industry. Last week, Odlum Brown Equity Analyst Stephen Boland offered a candid and insightful look at autonomous passenger vehicles and the road ahead, which I’ve summarized below.

Driverless vehicles could change the way we live and there are many reasons to be optimistic about their introduction. However, human behaviour is difficult to change and there are numerous challenges to overcome before autonomous vehicles become commonplace:

1. As much as people may want change, they tend to resist it. For instance, cars in the U.S. started to take off in the early 1900s, almost 100 years after the first car was developed.Similarly, the automatic transmission was created in the 1930s, but didn’t become mainstream until the 1980s. The development cycle of hybrid vehicles was more than 25 years and the navigation system took more than 30 years. Change is slow and we think that could remain the case with autonomous driving.

2. Consumers are also cost-conscious. At the moment, autonomous vehicles are very expensive. While costs will likely come down over time, there may still be a differential. Will consumers be willing to pay?

3. For autonomous vehicles to operate effectively, roads need to be well-marked and in good condition. Potholes, dirt roads, poor signage – all of these and more will need to be upgraded and maintained. Think of the costs, effort and collaboration that this will entail.

4. Some people just love to drive. They like to be in control and driving is more than just transportation, it is enjoyment.

One final point to consider: while driverless vehicles may someday be the norm, how do you know which company to invest in today? There are countless companies working on autonomous vehicles and associated technologies, just like there were hundreds of car manufacturers in the early 1900s. Not all of them will survive.

Autonomous driving is an interesting industry and it is certainly on our Research Department’s radar. Our analysts are always watching for new opportunities as well as keeping an eye on how changes may affect the businesses we already own. Both eyes are on the road ahead!

Change is good, right?

by Shelly Appleton-Benko | October 13, 2017

Fall is here and the change in our weather has arrived. The markets were quite volatile this past quarter as we saw the Canadian dollar strengthen against the U.S. dollar by 5%. This uptick in value affects portfolios holding U.S. securities. Reported in Canadian dollars, these U.S. stocks will likely present themselves as a drag on portfolio performance. Although we can’t predict the direction of the U.S. exchange rate, we are still very confident in our U.S. holdings and believe that staying the course is prudent at this time.

The Canadian economic numbers appear to be getting stronger. As a result, we are starting to see the Bank of Canada begin to raise interest rates. Small and controlled rate increases are thought to temper the consumer’s appetite for debt. As valuations overseas look quite attractive, we may consider adding some European exposure as well.

Feel free to contact me if you have any questions.

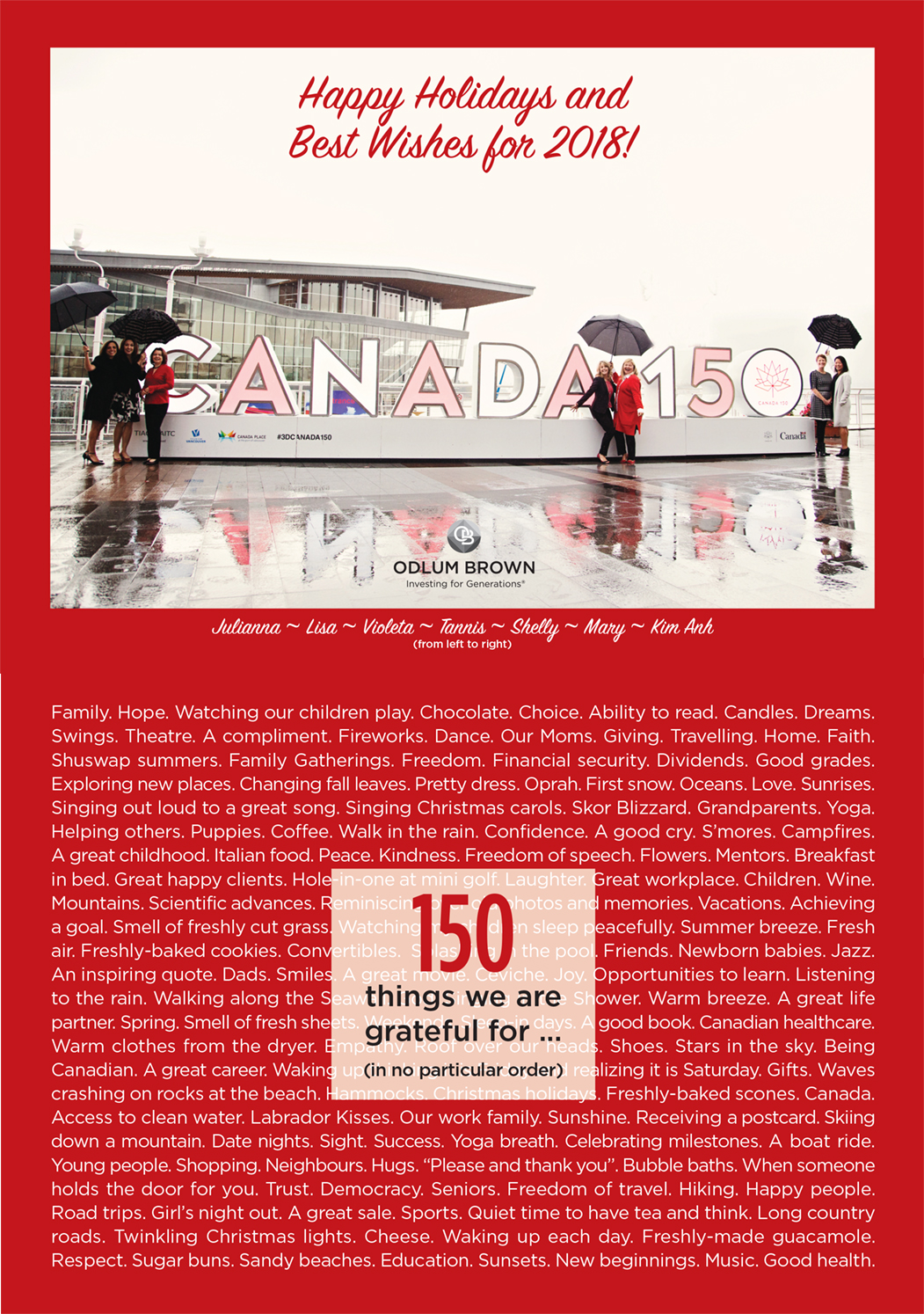

Celebrating: Family + Award

by Shelly Appleton-Benko | August 15, 2017

“Walk with the dreamers, the believers, the courageous, the cheerful, the planners, the doers, the successful people with their heads in the clouds and their feet on the ground. Let their spirit light a fire within you to leave this world better than when you found it."

– Wilfred Peterson

I am excited to share some family news with you. As many of you may be aware, our family has been involved with the WE Charity organization for the last five years. WE Charity empowers change with resources that create sustainable impact. They do this through domestic programs like WE Schools and internationally through Free The Children’s WE Villages. Our family trips to Kenya and Ecuador were with WE, where we helped build classrooms and water towers for clean water.

In June, we were honoured to learn that our family was nominated for a WE Family Award in recognition of Canadian families who are working to make a meaningful difference and build a better future. In particular, our family was nominated for the work we’ve done to encourage youth to appreciate all that we have in Canada, and enlighten them to the challenges faced by people in developing communities.

This past month, we received news that our family was selected as an award recipient! We are extremely moved by the recognition. In September, our family will be presented with the Award at WE Day Family Toronto and featured in Canadian Living magazine!

As family is the theme of the next few weeks for me, I wanted to share this news with you. I also would like to take the opportunity to wish you and your families all the best of the summer. I hope that you, too, will take a minute to appreciate this amazing country that we live in and just how fortunate we all are to have each other.

Summer Home Succession Plan

by Shelly Appleton-Benko | August 2, 2017

It brings me to this week’s topic on summer home succession, which may resonate with many clients. Succession of your summer home can bring up a lot of questions: Will the kids want ownership passed to them? When is the best time to pass it on? Will the siblings get along as co-owners? Who will maintain the property? How should costs be shared – evenly or proportionate to the usage? What if one wants to or needs to sell and the other doesn’t? What about succession if one person divorces – is the ex-spouse entitled to half or does it go to the grandkids?

Wow! Those carefree summer thoughts have just turned into a laundry list of things to figure out. A well thought-out plan or perhaps a more formal agreement prepared by your professional, tax and legal advisors addressing the issues above can go a long way in reducing future stress – so everyone can continue to enjoy the summer days.

Countdown to T+2 Transition on September 5, 2017

by Shelly Appleton-Benko | July 20, 2017

Pop Quiz: Any idea what the industry jargon “T+2” refers to? If not, don’t worry; you are not alone. Here are the basics.

T+2 refers to the number of business days between when a BUY/SELL order or trade (T) is placed and the day it settles (+2) in your account. Currently the settlement cycle is T+3. As of September 5, 2017, the Canadian and U.S. investment industry will be transitioning to a T+2 settlement cycle.

What does that mean for you?

The shortened settlement cycle means that settlement for purchases and sales will be shortened by one day. As such, payment for BUY orders will be required one day earlier than in the past.

When There Is a Will, There Is a Way

by Shelly Appleton-Benko | July 5, 2017

Recently, a client unexpectedly passed away without a will. This is another reminder to us all that your financial affairs are important and need to be treated as such. We have spoken with many of our clients about the importance of having a current will that states what you would like done with your financial asset and how you would like to handle non-financial matters (i.e. children or legacy) upon your death. This is a very important piece to the financial plan that needs to be created with the advice of a legal professional. If you need some assistance in organizing a list of your assets before going to see someone, please give us a ring and we can help with the details. Your will is the only way you can ensure that your wishes are carried out correctly, so please take the time to create one, review it and make sure that it reflects your wishes.

Additional Resources for Wills and Estates:

What lessons did your teachers leave with you?

by Shelly Appleton-Benko | June 19, 2017

As the end of the school year approaches and all of the year-end assemblies are upon us, I can’t help but think about how quickly the first six months of 2017 have flown by! The summer is almost here and the markets seem to be just as turbulent as they were in January. The political arena continues to be cloudy both provincially here in B.C., as well as in the U.S. I can’t help but wonder what will transpire in the next few months and I am sure many of you are thinking the same.

While we continuously monitor client portfolios, we will take a more in-depth look in the upcoming weeks as part of our quarterly review and will be making any changes required to assist in weathering the unpredictable storms ahead. For clients, if you would like to review your accounts in detail sooner, please feel free to contact us at your convenience. As my grade five teacher Mr. Ellis always said, “If there is an interruption to your immediate plans, don’t avoid it, embrace it and see what difference you can make in your life with that change. The interruption was sent for a reason.”

Introducing Violeta

by Shelly Appleton-Benko | May 29, 2017

Should you move in together?

by Shelly Appleton-Benko | May 16, 2017

The daughter of one of my dearest friends is considering moving in with her significant other. I am motivated to write a piece to inspire millennials who are in a similar mindset to consider the financial planning opportunity. BEFORE you sign the rental agreement, there is a lot to consider that could affect your financial future.

In British Columbia, according to CBC News (March 18, 2013), the number of couples who live together is growing at three times the rate of couples who get married. The BC Family Law Act is an important consideration for those who are deciding to share a home, paycheque and maybe even creditors going forward. In BC, you are considered a spouse if you have married or if you have lived in a marriage-like relationship for two years under the same roof. You are considered a spouse after 12 months for the purposes of the Canadian Revenue Agency (CRA).

If there is someone in your life who is considering this step, they should consult a family lawyer. There are also financial implications. If you think they could benefit from financial advice on these timely decisions and considerations, please pass on our contact information. We’re here to help get them started in the right financial direction.

Spring has Sprung a Leak

by Shelly Appleton-Benko | April 6, 2017

It has been raining cats and dogs in Vancouver this past month. Although depressing, the gloomy weather can keep us indoors and give us time to work on projects like Spring Cleaning!

It has been raining cats and dogs in Vancouver this past month. Although depressing, the gloomy weather can keep us indoors and give us time to work on projects like Spring Cleaning!

The “leak” or big secret of the financial markets this Spring is that the correction everyone is talking about has not yet occurred and the quarterly market returns may have been, well, surprising. Just like the weather, we can’t predict the direction of the market in the next quarter, so we are reminded that this is a great time of year to look at the contents of your portfolio and ask yourself if it is time to partake in a Spring Clean.

If you wouldn’t buy a certain investment today, is it still lingering around in your portfolio (or financial closet)? Ask yourself how great it would feel to get the non-performers into something that feels like a better fit for your investment strategy.

It is not very often that an acquaintance offers to help with the cleaning, but in this case, we are making the offer. Call us and let’s discuss your financial closets. We are professionals who can get the job done quickly, easily and without attachment issues. If you need a “Spring Clean” for your finances, give us a ring today.

I’d love to hear from you!

by Shelly Appleton-Benko | March 30, 2017

This blog post is a little different from the rest.

Tell me:

There’s no right or wrong answer.

Email me your responses at [email protected]. I will summarize the answers and provide some insight in an upcoming post. Don’t worry, no specific names will be linked to the responses.

I look forward to hearing from you!

Federal Budget Highlights

by Shelly Appleton-Benko | March 28, 2017

As you may know, the Federal Budget was tabled on March 22, 2017. I would like to share with you some highlights compiled by Michael Erez, Manager of Odlum Brown Financial Services Limited, click here for more details.

Proposed Tax Measures at a Glance

Personal

- Extend anti-avoidance rules to RESPs and RDSPs

- Simplify caregiver credit system

- Expand employment insurance (EI) benefits

- Expand scope of medical expense tax credit

- Extend tuition tax credit for occupational skills courses

- Extend the mineral exploration tax credit for flow-through shares

Small Business

- Eliminate use of billed-basis accounting for certain incorporated professionals

- Clarify the determination of factual control of a corporation

- Review tax planning strategies involving private corporations

Other

- No change to the capital gains inclusion rate

- Eliminate Canada Savings Bonds

- Allow electronic distribution of T4 slips without consent

Please note that these are proposed changes, and will not become law until the draft legislation receives parliamentary approval.

Is that another executive order?

by Shelly Appleton-Benko | February 9, 2017

Over the first few weeks of the new U.S. presidential term, we have seen a lot of headlines and flashy media spots about the President’s executive orders. Maybe I am being silly, but I find myself asking what this really means to me and my investment strategy. Do I put away my chequebook and not buy great companies at good prices if the leader of a neighbouring country is considering a policy change? Is all the song and dance of signing these orders just a reality TV ploy to make us think that the new government is getting the job done?

Over the first few weeks of the new U.S. presidential term, we have seen a lot of headlines and flashy media spots about the President’s executive orders. Maybe I am being silly, but I find myself asking what this really means to me and my investment strategy. Do I put away my chequebook and not buy great companies at good prices if the leader of a neighbouring country is considering a policy change? Is all the song and dance of signing these orders just a reality TV ploy to make us think that the new government is getting the job done?

Remember why we invest in stocks and bonds in the first place. The purpose is to diversify our hard-earned money across sectors and businesses so that eventually there is a strong income stream and growth in our overall assets. Taxation and risk are considered in these decisions so that you can be confident your investments are doing what you intended for them to do.

If you are constantly worried about what our neighbours to the South are doing, then we urge you to review your portfolio. Political leaders come and go, but the one constant is that the companies we invest in adapt with their environments and the issues that present themselves. Stick to the knitting I say, and turn off the reality TV show.

What’s Your Limit?

by Shelly Appleton-Benko | January 25, 2017

Did you know that you can access your RRSP contribution limit online?

Did you know that you can access your RRSP contribution limit online?

It’s hard to believe we are already at the end of January! With only five weeks before the RRSP contribution deadline for the 2016 tax year (March 1, 2017), now is the time to consider topping up your contribution.

After filing your income tax return each year, the Canada Revenue Agency (CRA) issues a Notice of Assessment (NOA) that includes your RRSP Deduction Limit Statement. The statement shows how much you are entitled to contribute and deduct for the upcoming tax year and whether you may have over-contributed.

The government sets out the RRSP limit annually, which for 2016 is based on 18% of your 2015 earned income, up to a maximum of $25,370.

As always, factors that could impact how much you actually contribute may include pension adjustments, group RRSP contributions, recent over-contributions and Home Buyers’ Plan repayments.

Wondering how much you can contribute? Don’t have your NOA handy? Well, you can call the CRA; they will ask you a series of security questions to confirm it’s you and then provide the information. Alternatively, your RRSP limit is available online through CRA’s My Account and the MyCRA mobile app.

Find your 2016 contribution limit here.

Once you know your limit, compare it to your current contributions and determine if it makes sense to top up before March 1, 2017. Give us a call, we can help! For many clients, you may already be set for the 2016 tax year, but you can always get an early start for 2017!

Making big financial changes for 2017?

by Shelly Appleton-Benko | January 3, 2017

Getting your financial house in order isn’t easy. Some would say that it would be a job for the “hard pile.” Don’t be discouraged and remember that even one small consistent change to your spending or investment habits can yield amazing results in the coming year.

Saving up for retirement? Want to reduce your mortgage this year? Whatever your savings goal is, make it easier to achieve by focusing on one aspect of the savings.

Click here for some helpful tips to help you move from the “hard pile” to the “easy pile.”