2019: A Ripe Year in Review

by Shelly Appleton-Benko | December 30, 2019

The funny thing about peaches is that they can be perfectly ripe, but only for a short time and then they are suddenly rotten.

In 2019, the markets delivered surprising positive returns. No one, not even President Trump, expected returns in the high teens to surface given the turmoil around the world. Unresolved trade wars, pending impeachments, minority governments, climate strikes and technology changes have thrown our world into a tangled mess. All of these factors could affect the stock market at a moment’s notice, suddenly shifting from perfectly ripe to perfectly rotten, so it is particularly important to revisit your portfolio now and make changes in order to weather the potential storm of pending events.

Entertainment, convenience and climate change were the news highlights of 2019. Within 24 hours of launching, the Disney+ streaming service already had 10 million subscribers signed up! As the new decade begins, we expect to see some exciting developments in the world of entertainment, as Disney+ now joins Netflix, Crave and Amazon Prime, among others.

Speaking of convenience, did you know that it is possible to order a meal to your home or office and track where the delivery driver is in the process? You don’t even need to leave your desk! Amazingly, it is also possible for someone to plan your meals, buy your groceries and have them delivered in predetermined amounts to your home. If you are on a certain diet, no problem, the food that you need can be delivered to your work or home. Convenience is key.

It also seems that no one can leave their phone at home or disconnect anymore, even when they are travelling around the world. Convenience, accessibility and technology are of the upmost importance to our society and yet, we are holding climate strikes across the world, protesting the very things we appear to hold so dear. Something doesn’t seem right?

This year, the market’s top sectors were Technology, Utilities and Industrials and we were definitely invested in these areas. This trend was indeed our friend in 2019. Last year, we talked about opportunity knocking with a slow economy and we see that continuing into the new year. 2020 definitely feels like the start of a new and very interesting decade.

Hire the Gardener

by Shelly Appleton-Benko | November 6, 2019

As the seasons change, many of us will spend time raking the leaves and pruning back the shrubs in order to keep our landscaping orderly and healthy. So too, as Investment Advisors and Portfolio Managers, we now revisit portfolios through the lens of preparing for year end and future conditions. In particular, we focus on the capital gains and losses for non-registered accounts.

As the seasons change, many of us will spend time raking the leaves and pruning back the shrubs in order to keep our landscaping orderly and healthy. So too, as Investment Advisors and Portfolio Managers, we now revisit portfolios through the lens of preparing for year end and future conditions. In particular, we focus on the capital gains and losses for non-registered accounts.

This time of year, investors often consider selling investments to either take a capital gain that can be used against carryforward losses from previous years, or take losses on an investment during the current tax year. An overall total loss this tax year can be applied back three years against previously realized gains, or carried forward indefinitely for future use. This can be handy if you are anticipating capital gains from property sales or investment gains in the next couple of years.

Sometimes the strategy of tax-loss selling is simply to prune the portfolio by getting rid of the underperforming positions and cleaning it up in preparation for the new year ahead. Or, it may just be time to move the money out of an investment that has not done well and put the money back into another opportunity that has more future potential.

The investment returns this year have been healthy, so many investors may have realized capital gains on their accounts and as a result, may incur a higher tax bill resulting from these transactions in April. As always, passing on the information from your Notice of Assessment to your investment team can help to ensure proper recording of the gains/loss amounts realized overall, as well as help plan for the year ahead.

For corporations, please remember that tax-loss selling applies to you as well. If your corporate year end is different than December 31, your investment team can help ensure that your tax year-end selling is complete with plenty of time to spare.

We’ll take care of cleaning up the portfolios, so that you can focus on taking care of the yard work!

.jpg?sfvrsn=85879bb8_0)

Resilience Under Difficult Conditions

by Shelly Appleton-Benko | September 18, 2019

Last week, as part of our team’s strategic planning retreat, we had the opportunity to hike through Joshua Tree National Park in the Mojave Desert. It was truly an incredible experience. The surreal desert landscape is outfitted with boulder formations and mountains, a vast array of cacti and miles upon miles of protected Joshua trees.

Joshua trees are an amazing symbol of resilience. In part, the beauty of these trees is due to their gnarled and leaning stature. They are highly adaptable and survive in the relentless sun, with low humidity and a constant lack of moisture. In fact, these trees grow in the direction of the wind and can live for more than 500 years! They are a powerful reminder of survival under difficult environmental conditions and we can’t help but see a parallel with the stock market.

Market conditions are not always optimal; and some pundits fear that we are currently heading into harsh conditions – including low interest rates and political uncertainty, both domestically and abroad. That being said, we position our client portfolios to ensure that they can withstand market turbulence – and ideally, grow in the direction of the wind. We continue to take profits, alongside trimming portfolio positions where we’ve had growth and adjusting our asset mix where needed.

Similar to the Joshua trees that have survived a dysfunctional environment on Earth, we believe that the market will also continue to endure, despite the current conditions.

Check out the middle photo below to see the subliminal sign that appeared during our hike. A bull perhaps? We couldn’t help but smile!

(Click the middle image to enlarge it.)

Cinderella was Right!

by Shelly Appleton-Benko | June 26, 2019

Dreams do come true, but only if you don’t give up!

After defeating the Golden State Warriors on June 14, 2019, the Toronto Raptors became the first Canadian team to win an NBA Championship. The following Monday, 34% of Greater Toronto Area residents went to the victory parade downtown and celebrated in true “We the North” style! I have a few personal contacts in the Raptor’s organization and it feels like I have experienced the disappointment of the last two seasons firsthand, and now finally, the celebration of the championship!

These ups and downs remind me of the wins and losses that we experience every day in the stock market. For the most part, the markets have provided extraordinary returns this year and that primes us to expect the worst. Human nature makes us believe that since the returns have been good, there must be a levelling correction just around the corner, right? While we are not anticipating corrections like we saw in 2008 and 2009, there is always room to celebrate the victories as they come and it is good to take some money off the table when the returns have been profitable. Before the summer patio parties start, ask yourself if you have celebrated the victory yet and then put some money aside for a rainy day.

While we don’t have a crystal ball, we do know that when we invest in companies with great management teams and good business plans (no matter who is in office and/or what the current trade policies are), we can build wealth over time.

Share the Aloha

by Shelly Appleton-Benko | June 18, 2019

A couple of weeks ago, I visited the island of Maui for a bit of rest and relaxation. Throughout our holiday, we observed that “aloha” doesn’t just mean “hello” and “goodbye” – it is a term of love and affection, an energy that the communities embody. The literal meaning of aloha is “the breath of life.”

During our stay, many locals were talking about how global warming was affecting the weather and how the trade winds had been absent for the entire week, leaving everyone hot and cranky! (For the record, I was NOT cranky!)

Global warming is indeed a hot topic these days. Pollution and garbage are also a major concern in the Hawaiian Islands. Increased waste in the Earth’s oceans has found a pathway to Hawaii’s pristine beaches and is endangering many critical habitats in and around the coral reefs. This got me thinking, how can we help?

Odlum Brown offers you the option of receiving paper statements or electronic statements. Paper statements are easy to read and effortless to receive; however, they do have a major impact on our environment. In the past 40 years, paper use has increased by approximately 400% and deforestation is a major global issue. Aside from tree use, dangerous gases produced by paper production are a key contributor to acid rain and greenhouse gases. In addition, 26% of solid waste at our garbage dumps is paper!1

You can make a difference today by requesting your Odlum Brown statements be sent electronically and securely via the Client Centre. This means that your statements are available sooner, are easy to access and no matter where you are in the world, you can view your accounts. If you are interested in doing a small part to help reduce global waste, we encourage you to consider changing how you view your statements.

------

1 https://www.worldatlas.com/articles/what-is-the-environmental-impact-of-paper.html

Write Them Down!

by Shelly Appleton-Benko | June 11, 2019

Graduation season is upon us. Social media feeds are abuzz with photos of high school and post-secondary graduates celebrating this important moment. It’s a bittersweet time; the nostalgia of closing an important chapter and the excitement of new beginnings to pursue one’s goals and dreams.

Graduation season is upon us. Social media feeds are abuzz with photos of high school and post-secondary graduates celebrating this important moment. It’s a bittersweet time; the nostalgia of closing an important chapter and the excitement of new beginnings to pursue one’s goals and dreams.

I have always subscribed to the theory of writing down one’s goals – whether it be financial, retirement, personal or career goals. Whatever the goal, there is proof that writing them down can greatly impact the odds of transforming your desires into reality.

I recently came across an article by R.L. Adams in Money Magazine about the power of goal setting and thought it was worth sharing:

In the Harvard Business School MBA study on goal setting, the graduating class was asked a single question about their goals in life. The question was this:

Have you set written goals and created a plan for their attainment?

Prior to graduation, it was determined that:

- 84% of the entire class had set no goals at all

- 13% of the class had set written goals but had no concrete plans

- 3% of the class had both written goals and concrete plans

The results?

Well, you’ve likely somewhat guessed it. 10 years later, the 13% of the class that had set written goals but had not created plans, were making twice as much money as the 84% of the class that had set no goals at all.

However, the apparent kicker is that the 3% of the class that had both written goals and a plan, were making 10 times as much as the rest of the 97% of the class.

The study suggests that even if the only criteria for success was money, by having a plan and writing your goals down you will be more likely to achieve them. Therefore, whatever chapter in life you are in, be it high school or post-secondary (or even if you are a recent retiree), diarize the goals you want to achieve in order to reach your next destination!

Congratulations to all those who have achieved this milestone.

Meet our Team’s Newest Talent: Amanda Cochran

by Shelly Appleton-Benko | May 31, 2019

We are pleased to welcome Amanda Cochran, Investment Assistant, to further complement our support team. Amanda will be working with clients on account documentation and administration needs.

We are pleased to welcome Amanda Cochran, Investment Assistant, to further complement our support team. Amanda will be working with clients on account documentation and administration needs.

Amanda joins us after several years in the investment industry. Her experience and professional demeanor will ensure our clients continue to have a great Odlum Brown experience.

Amanda can be reached directly at 604-844-5486 or by email at [email protected]. Please join us in offering a warm welcome to Amanda.

Small Treats, Big Payoffs

by Shelly Appleton-Benko | May 24, 2019

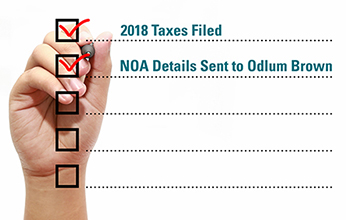

For most of us, our personal income taxes for the 2018 tax year have already been submitted to the tax man (a.k.a. Canada Revenue Agency). But, before you archive your 2018 “tax stuff,” let’s consider a couple of last-minute items on the to-do list.

For most of us, our personal income taxes for the 2018 tax year have already been submitted to the tax man (a.k.a. Canada Revenue Agency). But, before you archive your 2018 “tax stuff,” let’s consider a couple of last-minute items on the to-do list.

If you received a refund, it’s okay to consider a small “today” treat for yourself; say 10 or 20% of the refund. However, consider using the rest of the refund for your future self. A treat like paying off debt on your credit card or your mortgage; contributing a little extra to your RRSP to get the future tax benefit; maximize your TSFA; or set it aside for your child’s RESP or RDSP. Use it as a treat that keeps on treating – keep your money working for you!

Secondly, before you file away your Notice of Assessment (NOA), be sure to check it out, it contains some really useful information! The NOA is where you will find your RRSP deduction limits, Home Buyers’ Plan or Lifelong Learning Plan repayments, capital loss carryforwards or taxes owing. This information is important to you, and to us! We ask that you please send us the details (pdf copy or photo) via a secure email link before stashing it away until next year. Drop us an email if you need a link sent to you.

Celebrating MOM

by Shelly Appleton-Benko | May 8, 2019

The last few weeks have been personally challenging for me. My mom is experiencing a transition from her normal life towards accepting help in the home and more. This is a time of change for our family, and it reminds me of all the seasons of our life that we experience.

The last few weeks have been personally challenging for me. My mom is experiencing a transition from her normal life towards accepting help in the home and more. This is a time of change for our family, and it reminds me of all the seasons of our life that we experience.

This experience has made me consider what options are available for seniors in our community, and explore how you go about finding the important information needed to make the right decisions for our families. It is not just about the money you can afford to pay, there are so many other important considerations for quality of life. Recently, our geriatrician passed along a great resource book that lists local services available for seniors. We found it very helpful for engaging care workers, exercise classes, housekeeping, yard care and just about any other service that mom may need to carry on living in her own home.

Just like your financial plan, this time in a person’s life requires a special attention to detail. What do they enjoy the most? Are they a social person? Are they active? Doing what I love everyday keeps me balanced and energized, and I have realized through this experience with my mother, that perhaps we need to spend more time planning for these small, yet important, details once we reach our golden years. Is assisted living the only option? Do we need to save more so that we can stay in our own home? Is my forever home ideal if I have health issues? There are a number of important considerations to explore before reaching this stage in life.

Think of your own mom this coming Mother’s Day, and if she is like mine and needs a little more help these days, make a call and arrange something special for her this coming Sunday. Happy Mother’s Day.

Understanding the Classics

by Shelly Appleton-Benko | April 3, 2019

Recently, I came across an interview with singer/songwriter Don McLean – famous for his 1971 hit song “American Pie” – regarding his investments. Since many entertainers don’t often share their investment approach, I was intrigued.

Recently, I came across an interview with singer/songwriter Don McLean – famous for his 1971 hit song “American Pie” – regarding his investments. Since many entertainers don’t often share their investment approach, I was intrigued.

Interestingly, one of the questions asked during the interview was, “What is the best financial advice you’ve been given?” Now, before we share his response, let me begin by saying that Don’s approach appears to be in line with our strategy. We do not invest in anything that we don’t understand and we are diligent about sticking to our investment philosophy of holding stocks that provide us with consistent growth numbers over time. We all work hard for our money and no one wants to take unnecessary risks when you don’t have to.

Different from our approach, Don owns only two stocks in his portfolio, with the balance in bonds and preferred shares. Guess which stocks he owns? Amazon.com (AMZN) and Google (a.k.a. Alphabet Inc. – GOOGL). Just a couple of good ol’ American classics. Both are in the hypothetical Odlum Brown Model Portfolio, and for good reason. They are both good businesses, and we understand them. Here is what Don had to say in the interview about the best advice he had received:

A guy named James Benenson Jr., who was a very wealthy man and was once my business agent, told me, ‘Don’t ever invest in anything that you don’t like and understand.’ If you enjoy it and understand it and analytically it is a good investment, that’s a great thing. Then your money’s doing something that is pleasant for you. It’s not just a number.

I mostly am a bond investor. I have two stocks: Google and Amazon and that’s all. And I plan to hold those because they are the government, as far as I can see. I’ll probably add to those as we go along. I’ve earned maybe $150 million in my career, and that’s not too bad. And of course taxes were very high in the 1970s — probably 70% or something like that. What I was trying to do was not lose the money that I had worked hard for. Back in the ‘70s I had a lot of 5 and 6 and 7% governments and of course as rates came down I made money. Then, we hit 2008 and it was just a mess and I took everything I had out of governments and invested them all in corporate bonds. Really good companies. And that paid off like crazy. Some of my money is still in corporates and some is now in preferred stocks and so I get a little protection against the market and also benefits from the market. And that’s worked nicely. I try to get, like, a 6% return if I can — 5 or 6%. That’s enough for me.

The article made me smile and I hope it resonates with you as well.

Spring Forward

by Shelly Appleton-Benko | March 8, 2019

RRSP season is over and we are now getting ready for tax season. Before the search for slips begins, let’s take a much needed break. A break from rushing to get the funds invested before the deadline and rushing to collect all the slips for the accountant’s office. Let’s take a moment to look forward and consider the state of our investment accounts.

January and February 2019 returned a lot of value to many accounts following the market declines of December 2018. Many of us were glad to see green on the screen and may be asking ourselves if we need to revisit our annual spring cleaning exercise. Healthy earnings have pushed Technology and Consumer Staple stocks ahead and Commodities and Financial stocks have pulled back to attractive levels once again.

So, why not take this time to clean out the closets and make room for some new positions? If you were disappointed in December with your portfolio’s stability, then perhaps it is time to sell some equities and return to building a bond ladder. We are starting to see some attractive valuations, especially in the Canadian marketplace, so it may be the perfect time to spring forward with new investments and begin to clean up other holdings for the year ahead.

Generation Y Faces a Massive Savings Challenge

by Shelly Appleton-Benko | January 30, 2019

Yes, it is RRSP season and time to top up your TFSA, yet many young people are also faced with saving for their first house or paying off those pesky student loans.

Yes, it is RRSP season and time to top up your TFSA, yet many young people are also faced with saving for their first house or paying off those pesky student loans.

The U.S. Federal Reserve recently released a study that indicated the number of student loans has tripled in the last 10 years. What is even more surprising is that even if the payments to the student loan are low, students often chose to pay off the loan instead of contributing to their retirement savings. Even if a millennial has a small student loan, the decision to pay the loan off first before saving for retirement or buying a house may be incorrect.

If you are a member of Gen Y and have never taken out a loan, then you could save twice as much as someone who takes the loan repayment road by the time you are 30 years old; not to mention the tax savings that comes with an RRSP contribution. Additionally, an RRSP can also be used towards a first-time home down payment using the Home Buyers’ Plan (only available in Canada). If you know someone who is trying to decide which path to take, tell them to give us a call and we can explain how to put the power of compound interest to work!

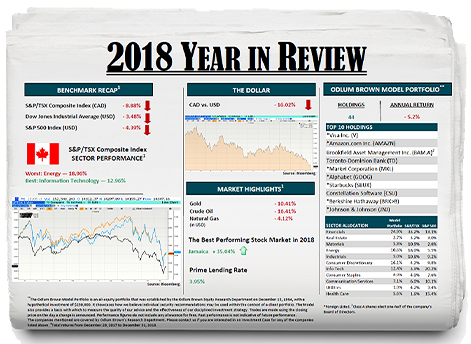

The Year in Review

by Shelly Appleton-Benko | January 10, 2019

(Click the image to enlarge it.)