.jpg?sfvrsn=2c3595b8_2)

Thank You, Charlie Munger

By Shelly Appleton-Benko | November 30, 2023

“The big money is not in the buying or selling, but in the waiting.”

— Charlie Munger

Tuesday afternoon, the sad news of Charlie Munger’s passing, just one month prior to his 100th birthday, blanketed our office. Word spread quickly, with the most profound message coming from a long-time client who simply wrote, “Thank you, Charlie” in an email to me today.

This is the first of many days that will inevitably come when the old guard of investing superheroes pass on. For the past 28 years we have been quoting Charlie, Warren Buffett’s partner and famous business sidekick. They were both from Omaha, with deep roots in their hometown and a belief in the old-school ways of finding value in businesses and waiting with patience to see the compounding returns work their magic.

Many of our analysts have made the trip to the annual Berkshire Hathaway meeting where both Warren and Charlie would sit together and enlighten the group on investing ideas, new and old. Charlie taught us how to look for great businesses at reasonable prices. He was full of sayings that were often referred to as “Mungerisms.” We will look back on these with a smile and will likely continue to use them for years to come.

The one that resonates with me most is, “Three rules for a career: 1) Don’t sell anything you wouldn’t buy yourself; 2) Don’t work for anyone you don’t respect and admire; and 3) Work only with people you enjoy.”

I believe that we live and breathe these rules at Odlum Brown each and every day. Thank you, Charlie, for all you have taught us over the years, and may you rest in peace.

To Shop or Not to Shop: Black Friday

By Shelly Appleton-Benko | November 21, 2023

According to the History Channel, the first-ever recorded use of the term “Black Friday” was over 150 years ago on September 24, 1869, to describe the U.S. gold market crash – a major financial crisis of its time. Many other theories as to its origin have circulated over the years. Today, Black Friday has spilled over into Canada and is more synonymous with the so-called amazing deals and retail chaos that follows U.S. Thanksgiving. The most common narrative of this more current tradition is when retailers finally earn a profit and go into the black.

According to the History Channel, the first-ever recorded use of the term “Black Friday” was over 150 years ago on September 24, 1869, to describe the U.S. gold market crash – a major financial crisis of its time. Many other theories as to its origin have circulated over the years. Today, Black Friday has spilled over into Canada and is more synonymous with the so-called amazing deals and retail chaos that follows U.S. Thanksgiving. The most common narrative of this more current tradition is when retailers finally earn a profit and go into the black.

While it may be a great time for companies to get into the black, be aware not to put yourself in the red! The thrill of the chase and getting an item on sale might just fuel your passion for the holiday gift-giving coming in December. Spreading out the spending for the holidays often helps with keeping the credit card bill in January in check.

This year, many consumers are struggling to make ends meet, with some having to cut back significantly on the gift-giving season. Here are some helpful tips that were put together by my team to assist you with your budget for the upcoming holiday season and add a little something extra to your gift-giving this year.

- Consider giving the gift of your time. Spend precious time with your loved ones or share your skills to help them accomplish one of their goals.

- Plan a daytrip or explore the local neighbourhood. Visit a park, hike in the snow or plan a picnic along the river with friends. These memories are often better than any gift purchased.

- Make a donation on behalf of your friends to a local charity or organize a volunteer day with your friends in lieu of a gift and provide the extra hands needed at this time of year.

- If you have children in your home, encourage them to consider others at this time of the year. Sponsor a family in need. Kids love finding the perfect gift, oftentimes even more than grownups!

- Lastly, give a token gift to someone completely unexpectedly. Experience the true joy of giving more than receiving.

Whatever your Black Friday shopping experiences bring, don’t let it turn into a personal financial crisis. Be mindful of your longer-term financial goals! It’s not only smart, but you can still find ways to make the holidays magical.

Almost Time to Hibernate

By Shelly Appleton-Benko | November 2, 2023

As winter approaches, bears will soon be seeking shelter, and it appears they're not the only ones. The equity markets experienced a significant decline in Q3, with September marking a particularly rough month, down almost 5% in the S&P 500 Index. The primary culprits behind the market downturn were increasing interest rates and inflationary costs. Of the 11 sectors comprising the S&P 500, 10 experienced negative results in September.

As winter approaches, bears will soon be seeking shelter, and it appears they're not the only ones. The equity markets experienced a significant decline in Q3, with September marking a particularly rough month, down almost 5% in the S&P 500 Index. The primary culprits behind the market downturn were increasing interest rates and inflationary costs. Of the 11 sectors comprising the S&P 500, 10 experienced negative results in September.

The top performers were found in the Energy and Communication sectors, with Health Care, Utilities, and Real Estate Investment Trusts (REITs) falling behind the quarterly average. The positive results in the first six months of the year have been displaced by a “market bear,” dampening investor optimism. Wall Street now predicts that rates could remain elevated for an extended period.

It is an opportune time to remind clients that in the quarter ahead, investment accounts are being evaluated to realize capital gains and losses. This strategy can help optimize tax efficiencies, while we seek to rebalance portfolios to a more conservative outlook.

Moreover, those who donate securities to charities to avoid capital gains on stocks should be mindful of imminent changes slated for the upcoming 2024 tax year. If you are a perennial participant in annual stock donations to your favourite charities, a larger donation in 2023 may be the answer to get the biggest bang for your charitable dollars.

The Alternative Minimum Tax is not a new calculation; however, it is tricky to understand and with the new changes in 2024, this may impact clients who donate securities. For more information on these changes, please contact us.

While we would love for the market bears to be cozy in their hibernation dens, it is not quite the time for investors to consider being bullish on growth-based equities.

Patience is once again essential for the markets in the upcoming months. Our advice to gradually adjusting the portfolios and make those small changes now may ultimately result in better overall performance in the months to come, until those pesky market bears are ready to hibernate.

Home Is the Nicest Word There Is

By Shelly Appleton-Benko | September 26, 2023

“Home is the nicest word there is.” – Laura Ingalls Wilder

Inflation, interest rates and budgeting challenges can all be obstacles to becoming a first-time home owner. This year, Canada introduced the First Home Savings Account (FHSA) to assist Canadians in saving to purchase property in Canada.

The FHSA is a registered plan that allows

qualifying individuals* to save for the purchase of a first home, combining the tax-deductible benefits of the RRSP with the tax-free growth and withdrawal benefits of the TFSA.

Up to $8,000 can be contributed annually, with a lifetime maximum of $40,000. Unlike RRSPs and TFSAs, however, FHSA contribution room only begins to accumulate after you open an FHSA, and FHSAs can only remain open for 15 years – so plan accordingly. While FHSAs are typically opened by prospective home buyers, at any time the FHSA assets can be directly transferred to the account holder’s RRSP or RRIF without needing to have RRSP contribution room.

It is valuable to understand how FHSA accounts can work for you, but also how they can work together with RRSPs (and the Home Buyers’ Plan) and TFSAs, for maximum benefit.

For example, if you are earning $60,000 per year and could contribute a combined total of $15,000 annually to both RRSPs and an FHSA account, your contributions could be deducted to reduce your taxable income to $45,000. That could result in a nice tax refund when filing your return the following year, which you could use towards more RRSP or FHSA contributions, or perhaps towards your TFSA.

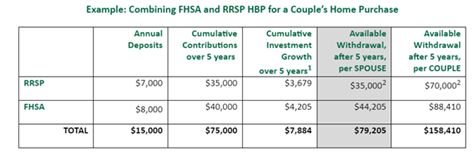

Consider a young couple looking to purchase their first home. Spouses (and common-law partners) can use FHSAs for the same qualifying home purchase, if they’re both eligible. They can also withdraw using the RRSP Home Buyers’ Plan for the same purchase, if eligible. As illustrated, if each spouse contributes $15,000 for 5 years, they could gather approximately $158,000 to buy a first home.

1Assumes 5% annual rate of return, net of fees

2Per maximum RRSP Home Buyer’s withdrawal limit

As you can see in this savings exercise, the FHSA can help put home ownership within closer reach with a diligent and purposeful plan. If you or someone you love needs to look into these accounts further, please give us a call. Remember that consistency plus discipline equals results, and what better reward than a place to call home!

*For more details on the First Home Savings Account and who is qualified to hold such an account, please find FHSA FAQs here.

Feeding the Wolf

Feeding the Wolf

By Shelly Appleton-Benko | September 14, 2023

Last week, I had the opportunity to hear and learn from Dr. Martin Luther King III and Mrs. Arndrea Waters King on the 60

th anniversary of Dr. Martin Luther King Jr.’s famous “

I Have a Dream” speech. There were many inspirational moments during the visit; one was their recount of the childhood fable of the Two Wolves. For those not familiar with the allegory, it serves as a timeless lesson about the internal struggles we all face when making choices. The two wolves are in constant conflict. Everyone has a good wolf (the positive qualities),

and a bad wolf (the negative traits). The battle: which one should you listen to? The ultimate victor of this internal battle is the wolf you CHOOSE to feed.

In the realm of finance, we consider this conundrum every time we pull out our wallet, and even each time we prepare our investment plans. We need to ask ourselves if we are feeding the good wolf that will assist in filling our buckets to meet our financial goals and dreams, or are we succumbing to the wolf that is tempting us with all things shiny – the impulsive wolf.

Allocating your funds with intention is important to the overall success of your investment strategy. Paying down debt, mortgage or otherwise should be paramount to your planning, but also important is adding to your savings buckets, whether that’s through RRSP contributions, TFSA annual amounts, or putting away funds for that new car or next year’s vacation. Monthly budgets are not static and need to be adjusted often to reflect the true picture. There are many electronic applications that can assist you with the process. Making good choices will help secure your financial future.

As the fable reminds us, our actions determine which wolf gains strength – it is the wolf you feed along the way.

Swift is Shaking the Earth and Jump-Starting the Economy

By Shelly Appleton-Benko | July 20, 2023

Taylor Swift, the iconic singer-songwriter has not only captured the hearts of millions of fans, but her concerts have emerged as a catalyst for stimulating the economy. Known for her chart-topping hits like “Blank Space” and “Shake It Off,” her concerts attract millions of fans.

In neighbouring Seattle, fans literally shook the earth, recording a seismic event equivalent to a 2.3-magnitude earthquake! Besides shaking the earth, the ripple effect of her concerts was recently recognized by the U.S. Federal Reserve as one of the recent triggers in boosting the economy. In fact, one research firm suggested that $5 billion – yes, you read that right – $5 billion, could be attributed to the singer’s Eras Tour so far. Host cities benefit from revenues generated from the ticket sales, merchandise purchases, hotels and transportation use from the influx of enthusiastic concertgoers. This cycle of spending generates jobs and incomes that contribute to overall economic growth.

Despite the current economic challenges and rising interest rates, fans are prioritizing attending her concert as a “priceless” experience. Apparently, there is a lot more joy found in going to a concert than the practical decision to make an extra mortgage payment or invest in your RRSP.

Remember – it needs to be a balance. Balancing responsible financial choices with occasional splurges on memorable experiences can be good for your well-being (and the economy!). It’s essential for all of us to be mindful of our spending and financial priorities for both our short-term and long-term goals. Make sure that those occasional splurges don’t shake you off your goals for a secure financial future.

It’s Wedding Season!

By Shelly Appleton-Benko | July 20, 2023

In a 2017 documentary, Warren Buffett said that one of the biggest decisions in your life is who you choose as your life partner. It’s a partnership, and it’s no secret that money can be a sensitive topic in relationships. Communication and finding common ground early around this topic is important.

In a 2017 documentary, Warren Buffett said that one of the biggest decisions in your life is who you choose as your life partner. It’s a partnership, and it’s no secret that money can be a sensitive topic in relationships. Communication and finding common ground early around this topic is important.

Among the joy and celebration around planning a wedding, be sure to set aside time to talk about some of these common financial considerations:

- Will you blend your finances, keep separate or have a combination of both? Do you understand the consequences of jointing accounts?

- How will you share expenses?

- Do you need to consider updating your beneficiary designations? (e.g., RRIF, RRSP, TFSA, pension plans and life insurance policies)

- Have you reviewed whether your life, disability and critical illness insurance coverage would be sufficient for your current and future needs?

- Do your legal documents like a will or Representation Agreement need to be updated?

- Do you need to change who is on title for your real assets (e.g., property, car)?

- Have you discussed your financial goals – short-term and long-term savings goals, debt-repayment strategies, planned retirement dates?

- Don’t forget there are income tax benefits, too – spousal loans, optimizing claims for medical and donation credits that might be worth looking into as well.

- Would you benefit from a prenuptial or postnuptial agreement?

There is lots to consider and do, but it is so important to set a great foundation. Be sure to consult your legal, tax and insurance advisors for their expertise, too!

Wishing all of our clients and friends who are tying the knot all the best for a happy union!

“I’m Sorry, Dave. I’m Afraid I Can’t Do That.”

by Shelly Appleton-Benko | June 14, 2023

From Dave in 2001: A Space Odyssey to Ultron in the Marvel Universe, it feels like Hollywood has been preparing us for AI to take over for decades. More than ever, these stories we have come to know feel more like forecasting a future where life imitates art. Artificial Intelligence (AI) has rapidly become a more integral part of our lives, transforming industries and revolutionizing the way we interact with technology. This stuff is really incredible, and it begs the question of how it will change the world we know. Should we be excited or scared? What really is AI anyways?

From Dave in 2001: A Space Odyssey to Ultron in the Marvel Universe, it feels like Hollywood has been preparing us for AI to take over for decades. More than ever, these stories we have come to know feel more like forecasting a future where life imitates art. Artificial Intelligence (AI) has rapidly become a more integral part of our lives, transforming industries and revolutionizing the way we interact with technology. This stuff is really incredible, and it begs the question of how it will change the world we know. Should we be excited or scared? What really is AI anyways?

At its core, AI refers to the ability of machines to mimic human intelligence and perform tasks that typically require human cognition. The fundamental building block of AI is a neural network, a complex system of interconnected nodes inspired by the human brain. This “deep learning” uses these networks to enable machines to make predictions, recognize patterns and generate outputs.

Artificial Intelligence is like having a brainy computer buddy that can do some seriously cool stuff! It’s all about teaching machines to do tasks that usually need human smarts, but in a fraction of the time.

AI isn’t just some fancy lingo. It has the potential to be used in healthcare for diagnosing diseases, finance for fraud detection, creative outputs like writing poems or books, and so much more. One notable AI innovation is ChatGPT, an advanced language model that anyone can use and engage in natural and coherent conversations. This powerful tool is like a virtual assistant who can help with personal productivity, like drafting emails or answering questions, and even planning travel!

At the end of the day, the world we know today is absolutely going to change. That being said, AI can be thought of as a tool that will greatly increase productivity, but will never replace the need for a human touch. Jobs we know may change, but the days of mundane and repetitive tasks may be coming to an end, and the power of the human mind with the support of AI is something to be excited about! With respect to long-term strategic investments, we are mindful of those corporations that are actively engaging in AI and how these products will help revolutionize the world in which we live.

To learn more about how AI is incorporated into our investment portfolio, we will be hosting a webinar on July 6, 2023, with Steven Zicherman, Director, Equity Analyst, Technology and Healthcare. Stay tuned for further event details.

Taxes – Are We Done Yet?

by

Shelly Appleton-Benko | May 30, 2023

For many of us, our personal income taxes for the 2022 tax year have been submitted to the Canada Revenue Agency. (Self-employed persons need to file their personal income tax return by June 15, 2023, but any balance owing was due by April 30). So, what’s next?

Making the Most of Your Refund

If you received a refund, while a splurge might be tempting, this isn’t a lottery win. This is your hard-earned money that essentially the government was holding for you and is now giving back. Make the most of it. Pay off debt on your credit card or your mortgage; contribute to your RRSP and get the future tax benefit; maximize your TFSA; set it aside for your child’s RESP or RDSP. Keep your money working effectively.

Reminder: for those eligible, you can contribute up to $6,500 to your TFSA for 2023. Do you have contribution room to catch up on from previous years? Click here for more information on TFSA contribution room.

Had to Pay?

Are there any tweaks that you can make today, so you do not have to foot the bill again next year? If you are employed and have RRSP room available, will increasing your contributions help? Consider initiating or increasing a pre-authorized amount so it automatically deposits to your RRSP.

Received Your Notice of Assessment?

Your Notice of Assessment (NOA) contains useful information, including your RRSP deduction limit, Home Buyers’ Plan or Lifelong Learning Plan repayments, capital loss carry-forwards and/or taxes owing. Be sure to review the information and have it available for future reference, and contact us if you’d like us keep these details on file for you; we can send you a secure link to send them in. Click here for more information on understanding your NOA.

Missed the Deadline? Need to Make a Correction? Being Audited?

We have a great network of accountants. Let us know if you would like a recommendation and we can provide a few names so that you may find the best fit.

Please feel free to contact us with any other questions!

Meet Our Team’s Newest Talent

By

Shelly Appleton-Benko | May 11, 2023

Happy Spring!

By

Shelly Appleton-Benko | March 20, 2023

Where did the time go? The first quarter of the year is ending, and the first 12 weeks were filled with a lot of uncertainty, especially within the financial sector. The volatility feels endless with interest rate hikes, inflationary pressures, the latest news in Silicon Valley and the ongoing war in Europe. At our recent Annual Address, Murray Leith explained how the coming months will likely bring continued volatility and yet there may be hope on the horizon.

The corporations that we invest in are reporting better-than-expected earnings and the Bank of Canada has stalled on implementing further dramatic interest rate hikes for the moment. Still, we continue to be cautious as the variable mortgage rates are putting pressure on many individuals and we are watching how the real estate markets will respond.

Spring is a time to reveal the bulbs we planted last fall and clean up the gardens from the long winter days. Like the weather these past few weeks, we are beginning to feel like there is a change in the air. Bonds and Guaranteed Investment Certificates (GICs) continue to add a solid interest to our portfolios and complement our equity portfolios nicely. We are encouraged by some of the positive performances in the equity markets, but still feel that adding back some fixed income is the right thing to do. We continue to look for first-rate fixed income products that will provide a great income stream and capital preservation during this unstable time in the economy. The season may be changing today and the days are getting longer, but our investment acumen remains true to form. Invest in great businesses for the long term and your portfolios will continue to be rewarded in time.

Family Day

By

Shelly Appleton-Benko | February 20, 2023

Meet Our Team’s Newest Talent

By

Shelly Appleton-Benko | February 6, 2023

Time For Your New Year Money Chat

By

Shelly Appleton-Benko | January 13, 2023

Wait! Don’t disregard that last paystub of the year! The information on the remittance stub may be key for calculating your next year’s Registered Retirement Savings Plan (RRSP) contribution amount and it’s a great way to kick-start your new year money chat. The new year is a good time to revisit and review your finances for the upcoming year.

- Did you meet your savings goals?

- Were there any major purchases in your family? New real estate and/or major investments that need to be insured or added to your estate planning documents?

- New members to your family unit, by birth, adoption or marriage?

- New job? New remuneration? Time to increase those monthly savings amounts or expedite paying down household debt or mortgages!

Reviewing these questions is important for you to reach your financial goals efficiently and with confidence. Remember – it is not just about whether the stock market is going up or down or the performance of your investments today; this is a good habit essential for you to check off the items on your financial bucket list.

As always, my team and I are here to answer any questions you may have.

![]() 2022: The Master Builder

2022: The Master Builder

by Shelly Appleton-Benko | January 6, 2023

In numerology, the number 22 is known as the "Master Builder". When one thinks of a master builder year, you may imagine lofty returns and building wealth. However, 2022 brought us what I like to think of as a year full of change and renovation, as investors were forced to clean house, renovate the existing portfolios and prepare for higher interest rates, inflated prices and (gasp!) even a recession.

Take a look at our 2022 Year in Review: