The notorious FAANGM stocks – Facebook, Apple, Amazon, Netflix, Google and Microsoft – and other large and popular growth stocks like Tesla have experienced increased volatility recently, with big moves both up and down. That, in turn, has fuelled an intensified debate about whether a shift in market leadership from growth stocks to value stocks is unfolding.

Some believe that huge government deficits and abundant monetary stimulus will usher in an era of higher inflation and interest rates, which could benefit bank stocks and other cyclical value-type firms at the expense of growth stocks. Others fear that increased market turbulence is a sign that the economic recovery and bull market in stocks are at risk. Variables complicating the debate are an uncertain outcome of the U.S. election, the threat of a resurgence of COVID-19 cases and the unknown timing and efficacy of a vaccine or treatment. There are no clear and easy answers, which is why we keep stressing the importance of balance and diversification within investment portfolios.

Nonetheless, the aim of this article is to explain where we stand on the growth versus value debate, and highlight how our view and the use of the different investment styles have evolved. To start, it’s worth sharing an excerpt from our May 2015 Odlum Brown Report, “Water the Flowers”:

Many fund managers trim or sell stocks that are performing well while adding to losing positions. It’s a logical buy-low/sell-high strategy, but one that legendary mutual fund manager Peter Lynch felt amounted to “pulling the flowers and watering the weeds.”

Earlier in my career, I didn’t fully appreciate Mr. Lynch’s wisdom. In my first decade at Odlum Brown, the turnover in our Model Portfolio1 was two to three times what it has been in recent years, as we regularly took profits on winning situations and reinvested in laggards. It’s a strategy that worked well, yet our investment approach evolved.

Increasingly, we are interested in watering the flowers. We still like to be opportunistic and are attracted to out-of-favour stocks, but more and more, we prefer successful companies that are performing well in the stock market.

We used to avoid stocks with above-average multiples, but we have come to appreciate that high-quality companies warrant above-average valuations.

It might seem like we have become “growth” or even “momentum” investors, but we are still “value” investors aiming to own stocks that trade at a discount to intrinsic value.

From experience, and by studying other great investors, we have learned that it’s worth paying a premium for better businesses, stronger management and faster growth.

[Warren] Buffett says it’s not appropriate to make a distinction between value and growth. Value and growth are joined at the hip, with growth a key component of the value equation.

Contrary to the optics, we didn’t just suddenly change our investment approach. The appeal of high-quality growth stocks was apparent to me almost two decades ago. I found the proof when I was dusting off Phil Fisher’s excellent book, Common Stocks and Uncommon Profit, in preparation for the 2015 Odlum Brown Annual Address. I first read the book in 1997, and I was re-reading it to refine my view on when to sell great companies. Mr. Fisher didn’t believe in selling great companies, even when they were temporarily expensive.

As a young analyst in 1997, I made a lot of interesting notes in the margins of Mr. Fisher’s book. The most insightful note was at the end of the chapter on “When to Sell.” It stated, “When great companies get cheaper, change my investment philosophy.”

Growth stocks were particularly expensive in the late 1990s, and it wasn’t just dot-com technology companies that commanded crazy valuations; America’s biggest and best blue chip companies were also highly sought after and pricey.

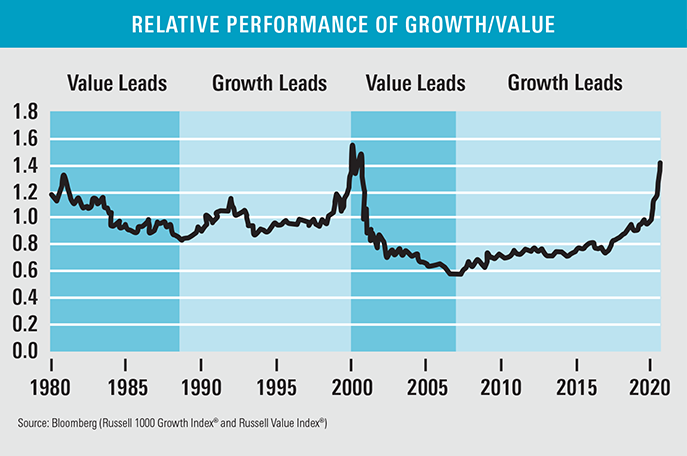

Patiently waiting for the opportunity to buy higher-quality growth businesses served us well, as the growth stock mania in the late 1990s ended very badly. The point is highlighted in the chart below, which compares the relative performance of growth stocks versus value stocks. Note the huge upward spike in the line around the turn of the century and the dramatic fall afterwards. The pendulum swung hard from growth to value, and we were fortunate beneficiaries as we had most of the Odlum Brown Model Portfolio invested in attractively priced Canadian value-type stocks at the time.

Value stocks took over market leadership in the 2000s after the dot-com companies crashed and big American blue chip stock valuations started a long, downward retrenchment to reasonable levels. Resource stocks were among the market darlings during this resurgence of the value investment style, but like the dot-com mania before it, the resource craze ended badly.

Fortunately, we didn’t get carried away overemphasizing value stocks and instead seized the opportunity to shift a lot of money out of Canada and into U.S. blue chip growth stocks in the mid-2000s.

Our timing hasn’t always been perfect, but with our overall strategy generally aligned with the big investment style shifts over the last two decades, we have done well. Over the last 20 years, our Model has grown at a compound annual rate of 11%2, roughly double the rate achieved by the main Canadian and U.S. equity benchmarks (4.7% and 5.6%, respectively).

Whether our past success is due to luck or brilliance, the question at hand is whether another major investment style shift is on the horizon.

A year ago, we concluded that growth stocks’ valuations were still reasonable and that they would most likely continue to outperform value stocks. Indeed they have: as of mid-September, the Russell 1000 Total Return Growth Index was up 36% compared to a year ago, while the Russell Value Total Return Index was down 4%.

Investor preference and passion toward growth-type stocks was well developed prior to the COVID-19 pandemic, and there was good reason for the positive assessment: the businesses were growing faster and creating more fundamental shareholder value than their value counterparts. The COVID-19 crisis has accelerated and amplified the fundamental appeal of these stocks, as businesses like Amazon and Apple have thrived in world lockdowns, while economically sensitive value stocks like Royal Bank have struggled. Consequently, growth stocks have recovered much faster than value stocks, such that the valuation spread between the two groups is near historic extremes.

Last October, the ratio of growth-to-value in the chart shown above was roughly 1.0 and back to where it was before the speculative growth mania took off in the late 1990s. Since then, the ratio has vaulted higher and is now closer to the levels it reached at the pinnacle of growth outperformance. That alone is reason not to be overly exposed to pricey growth stocks. Balancing one’s portfolio with less exciting, yet good businesses is increasingly important.

While we have definitely put an emphasis on large, high-quality, American-listed, growth-type businesses in recent years, we have always had ample diversification in businesses with value attributes as well. Less than 25% of our Model Portfolio is currently invested in popular and pricey stocks like Apple and Amazon. That’s considerably less than their representation in the U.S. S&P 500 Index, which is why we have not kept pace with that benchmark so far in 2020. The comfort is that our relative performance should improve if, and more likely when, there is a shift from growth to value.

A stronger economy and/or higher inflation and interest rates are ingredients that could enhance the relative appeal and performance of value stocks. While such developments are certainly possible, they are not guaranteed. That’s why we are not making any bold declarations regarding a preference for either growth or value stocks. We like both.

1 The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

2 As of September 15, 2020

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.