After building wealth over your lifetime, it is worth considering how trusts might protect your wealth for you and future generations to enjoy.

After building wealth over your lifetime, it is worth considering how trusts might protect your wealth for you and future generations to enjoy.

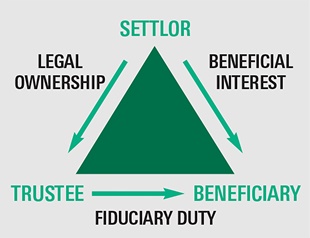

A trust is established when someone, a settlor, gives legal title of their assets to a trustee, to hold for the benefit of another person or group of persons called beneficiaries. Trusts essentially separate legal title of property from its beneficial interest. While a trust deed often documents the settlor’s intentions, a trust relationship can exist without one.

Trustees have a fiduciary duty to manage trust property in the best interests of the beneficiaries. Although trustees can be individuals, a corporate trustee may provide impartial, capable and ongoing service.

Types of Trusts

Trusts may be set up during the life of a settlor (inter vivos – “between the living” in Latin) or as a result of that individual’s death (testamentary). Common inter vivos trusts include alter ego, spousal, joint partner, charitable remainder and family trusts. Testamentary trust examples include your estate, and individual or family trusts arising from your will.

Alter Ego, Spousal and Joint Partner Trusts

An alter ego trust is established initially for your (the settlor’s) lifetime benefit, whereas a spousal trust is initially for the lifetime benefit of your spouse or common-law partner. A joint partner trust is initially for the lifetime benefit of both you and your spouse or common-law partner. Any remaining trust assets can pass to residual beneficiaries of your choice, outside of your estate, following the death of the lifetime beneficiary(ies).

You (and your spouse, if a joint partner trust) must be at least age 65 to establish the trust and transfer assets to the trust on a tax-deferred basis (i.e., rollover). Once the trust is established, you retain all rights to the income and capital while you are alive, and benefit from continuous trust management and protection against undue influence over trust assets if you became incapacitated. Further, your chosen beneficiaries gain prompt access to the trust assets following your death.

Taxation of Trusts

A trust can earn income and deduct any income it allocates to a beneficiary during the year. Any net income remaining in a trust is generally subject to the top marginal tax rate and, as a result, the general goal is to allocate net income to beneficiaries such that the trust reports no net income. However, certain trusts are eligible for graduated tax rates. For some trusts, on every 21st anniversary of the trust’s settlement date, the trust is deemed to have disposed of all of its property for income tax purposes, triggering capital gains tax. Strategies may be available to limit or defer this tax.

The Need for Advice

Since planning considerations are complex, you should obtain professional tax and legal advice before enacting any estate or trust planning. Topics to consider with your advisors include the following:

Investment management – Taking direction from the trustee(s), your Odlum Brown Investment Advisor or Portfolio Manager can continue managing your non-registered funds within a trust account.

Privacy – Instead of distributing assets upon death through a will that may become public knowledge when probated, inter vivos trusts allow assets to pass to beneficiaries privately. This may be useful for situations such as blended families or making unequal distributions to residual beneficiaries.

Protection from adverse claims – Unless assets are transferred with fraudulent intent, trust assets are generally protected from will variation, creditor and/or family law claims against the deceased’s estate.

Income tax deferral – Settling assets to certain types of trusts (e.g., family trusts and testamentary trusts created for beneficiaries other than spouses or common-law partners) is done at fair market value, which may accelerate income taxes on accrued gains. Such trusts are also deemed to have disposed of trust property and recognize accrued gains every 21 years. Alter ego and joint partner trusts, on the other hand, can continue deferring unrealized capital gains on trust property until the death of the settlor (or until both spouses have passed, in the case of joint partner trusts).

Income splitting and capital gains exemptions – While income earned on trust assets may be attributed back to the settlor of the asset for tax purposes, using trusts may allow capital gains or income to be taxed in the hands of beneficiaries at a later date. Eligible beneficiaries may be able to claim the Lifetime Capital Gains Exemption when the trust sells qualifying private company shares, which could multiply the total exemption available per family.

Probate fee minimization – Probate fees, which vary by province, may be reduced by holding assets in an inter vivos trust. Seek professional advice regarding whether the costs for a trust might exceed the probate fees saved.

Charitable giving – If you use a trust for charitable giving, immediate or future donation tax credits may be available.

Continuous management by trustees – Once you transfer assets to an inter vivos trust, the trustees control the assets and decisions for the trust, as well as the allocation of income, even if you become incapacitated or pass away. This allows continuous access to an inter vivos trust’s income and capital by its trustees for the benefit of the beneficiaries. In contrast, assets that pass through your estate are often inaccessible by your executor, trustees and beneficiaries until probate is granted – a court process that may take several months or longer.

Power in multiple jurisdictions – In some situations, using an inter vivos trust might preclude using multiple powers of attorney and/or wills to deal with assets located in other jurisdictions (for example, property in other provinces or countries).

Not all assets can be held in trusts – For example, RRSPs, RRIFs, TFSAs, RDSPs and RESPs.

Costs – Legal and accounting professionals are typically involved in setting up trusts. Initial costs are impacted by the types of assets to be re-registered, as well as the number of locations or institutions involved. After a trust is established, ongoing accounting, tax filing (for T3 returns) and professional trustee fees can add to costs over the life of a trust.

Other taxes – Property transfer tax may apply when real estate is transferred to a trust. Holding a property in trust can negatively impact access to the BC home owner grant and, if the property is held entirely in trust, to property tax deferment in BC. Furthermore, principal residences held by a trust can lose their exemption from capital gains tax depending on the type of trust established. Other negative tax implications can result if trustees are not Canadian residents.

Settlor cedes control over property – Trustees, not the settlor, control trust property. Trustees follow applicable trust law and the terms that the settlor provides in the trust deed. Trustees manage and oversee the trust assets for the benefit of the beneficiaries. Any ability by the settlor to dictate the actions of the trustee or the use of assets can result in negative tax consequences.

If you are a U.S. person or are contemplating having trustees, beneficiaries or trust assets in a foreign jurisdiction, you should also consult with cross-border tax and legal professionals.

To better understand how trusts could complement your estate, incapacity and tax planning goals, please contact our Odlum Brown Financial Services Limited team through your Odlum Brown Investment Advisor or Portfolio Manager.

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited, offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.

The information contained herein is for general information purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. Many factors unknown to Odlum Brown Financial Services Limited may affect the applicability of any matter discussed herein to your particular circumstances. You should consult directly with your financial advisor before acting on any matter discussed herein. Individual situations may vary.