In May, I attended the Mauldin Economics Strategic Investment Conference. It was the second time I’ve attended the virtual event, and it was a fantastic opportunity to hear perspectives on the outlook for the economy and markets from some of the brightest minds in the industry. The most discussed and debated topic was the threat of higher inflation, and there were strong and convincing arguments made on both sides.

Any doubt that inflation would accelerate in the near term was firmly put to rest toward the end of the conference, when the United States reported a blockbuster 0.8% increase in the Consumer Price Index (CPI) for April. That was four times the 0.2% consensus expectation, and it brought the year-over-year change to 4.2%, the highest rate of inflation since September 2008.

Some believe that massive government deficits and central bank money printing will lead to a sustained period of higher inflation, while others argue that higher inflation will prove to be a transitory phenomenon. We believe that growth and inflation will moderate once economies are fully open, but also appreciate that there is a risk to that view.

Understanding the future course of inflation is important for investors because it influences the purchasing power of our savings, the level of interest rates, corporate profit margins and asset valuations. While interest rates tend to move in the same direction as inflation, it’s much tougher to generalize about the influence of inflation on corporate profits and asset valuations. There are many nuances and exceptions to the theoretical rules that need to be explored.

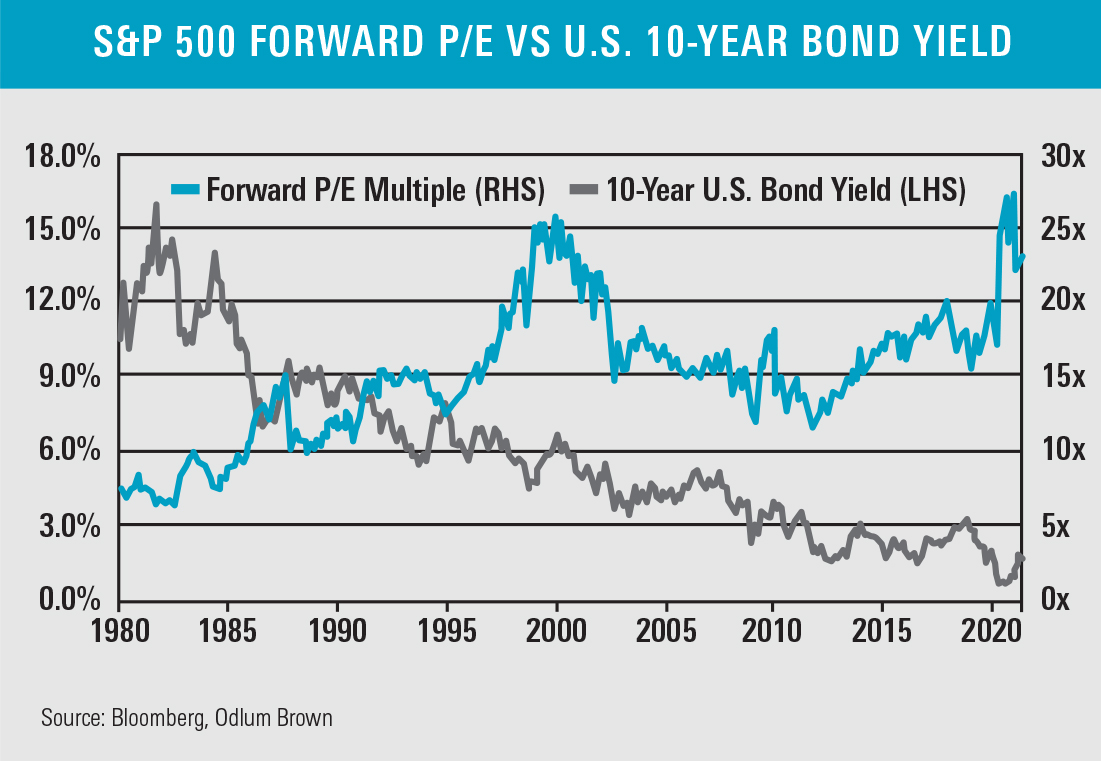

For perspective, let’s start by looking at the long-term relationship between bond yields and stock valuation multiples. The yield on the 10-year U.S. Treasury bond peaked at around 16% in the early 1980s and steadily declined over the last few decades as inflation decreased. Indeed, inflation fell so far that concerns about higher prices eventually morphed into fear about outright deflation in the wake of the COVID-19 pandemic, with 10-year yields reaching a low of 0.5% in July 2020. As interest rates dropped over the last four decades, valuation multiples went in the opposite direction; the forward price-earnings (P/E) multiple for the S&P 500 Index increased more than fourfold from a low of 6x (when bond yields were 16%) to more than 25x recently. The expansion in valuation multiples has greatly enhanced investors’ stock market returns, which, without changes in valuation multiples, are driven by a company’s earnings growth and dividends.

Just as stock valuation multiples have risen with the decline in inflation and interest rates, bond valuations, real estate and other financial assets have been similarly buoyed. In fact, the inverse relationship between interest rates and stock valuations is similar to the relationship between mortgage rates and home prices. When rates are low, buyers can afford a larger mortgage and are therefore willing to pay more for a home.

The worry, of course, is that a sustained period of higher inflation and interest rates will cause valuation multiples for most asset classes to go in the opposite direction. Indeed, that is what recently happened for the S&P 500 Index: the forward P/E multiple dropped from more than 25x to roughly 23x as bond yields rose from 0.5% to 1.6%.

Nonetheless, the S&P 500 has powered higher despite the retrenchment in the valuation multiple. That is because the economy is booming and corporate earnings are growing faster than valuation multiples are contracting. That is one of the important nuances about the effects of inflation and interest rates on stock prices. Inflation is cyclical and normally a consequence of stronger economic growth, which tends to have a positive influence on corporate profits.

Determining which stocks will be positively or negatively influenced by stronger economic growth and higher inflation is definitely more art than science. Some businesses handle inflation better than others and are able to pass increased costs on to customers. That’s why we focus our investments on the best businesses with sustainable competitive advantages and pricing power.

When it comes to thinking about inflation, interest rates and stock valuations, it’s also important to consider the exceptions to the general rules and trends.

The P/E multiple for the S&P 500 declined from over 25x at the turn of the century to a low of about 11x in late 2011 despite an ongoing trend to lower interest rates. Theory and reality were not in sync over this period because investor sentiment swung from euphoric to pessimistic extremes. In the late 1990s/early 2000s, many of the technology and other large companies that dominated the index were unjustifiably expensive relative to both their earnings potential and interest rates. Once the bubble burst, the sentiment and valuation pendulum swung to an undervalued extreme despite the positive influence of lower interest rates.

In Canadian dollar terms, the S&P 500 Total Return Index declined by 34% in the 2000s. Still, there were plenty of stocks that benefited from an expanding economy and lower interest rates during that period. The Odlum Brown Model Portfolio1 owned many of those businesses and achieved a return of 245% in the 2000s.

The starting level of valuations had a huge influence on which stocks did well in the 2000s. Those that started the decade neglected and cheap ultimately far outpaced those that were initially popular and pricey.

The point we are trying to make is that markets are dynamic and influenced by many factors. It is the interaction of all these factors that ultimately determines individual stock performance.

While we worry about the possibility of higher inflation, we spend most of our time thinking about the relative competitive positions, growth prospects and valuations of the businesses we own and recommend. Moreover, we think about the health of these businesses and the state of the economy three to five years ahead.

Over that horizon, we believe the inflationary supply and demand imbalances caused by the pandemic will fade, and that the deflationary influence of deteriorating demographics, excessive debt and technology advancements will keep prices in check.

Businesses with higher, but still reasonable, valuations and higher growth prospects will likely do best if growth and inflation abate as we expect. On the other hand, lower-priced, slower-growing businesses stand to be the market leaders if robust economic growth is sustained and higher inflation persists. We are hedging our bets and protecting portfolios from the risk of higher inflation by owning both types of stocks.

1 The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.