Critical Illness Insurance for Your Long-Term Care

By Debbie Stuart, CLU, CHS,

Estate and Insurance Planner,

Odlum Brown Financial Services Limited

World-renowned heart surgeon Dr. Marius Barnard often witnessed the financial and emotional strain his patients faced after surviving serious illnesses and how, in many cases, they struggled to pay bills as they recovered and resumed their lives. He went on to help develop critical illness insurance.

As your life progresses, you appreciate the value of having plans in place if health challenges arise. Critical illness (CI) insurance offers you and your loved ones the financial help to ease the stress associated with life-altering illnesses. A lesser-known aspect of CI insurance is that some policies can do double-duty, protecting you upon a critical illness and the need for long-term care. We’ll look closer at CI policy features and benefits to explore how this coverage works.

Availability – While typically available between ages 18 to 60, CI coverage is most affordable for applicants who are in their early 50s or younger.

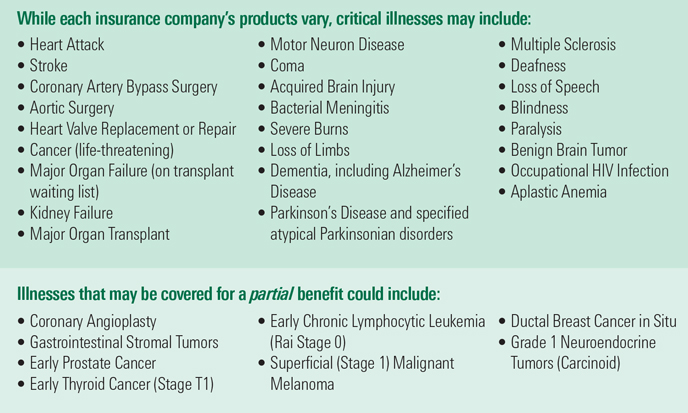

Benefits – Policies can cover many medical conditions (see below). If you meet policy conditions, your CI benefit amount is paid to you as a tax-free lump-sum payment. Some policies may offer further coverage if you are diagnosed with a second illness after receiving a benefit for the first.

Use of Benefits – You do not need to repay the funds, whatever your health outcome, and are free to use the benefit amount in any way. For example, you may wish to use the funds to:

- Pay for medical costs such as prescriptions and equipment

- Replace lost income

- Pay mortgages or debts

- Hire a nurse or caregiver to help you out at home

- Find the best health care available – anywhere

- Arrange a life-affirming trip or time with loved ones

Coverage Periods – You can enjoy permanent coverage for your entire lifetime or coverage for a specific period, such as 10 or 20 years, or to age 65 or 75. Premiums on permanent policies can be structured to be paid over your lifetime or for a fixed number of years.

Return of Premium on Death – This optional feature on a CI policy offers a tax-free payment to your estate or named beneficiary if you die without making a claim.

Return of Premium on Surrender or Expiry – Available on permanent plans, this optional feature returns 100% of eligible premiums paid if the policy has been in force for the required period of time.

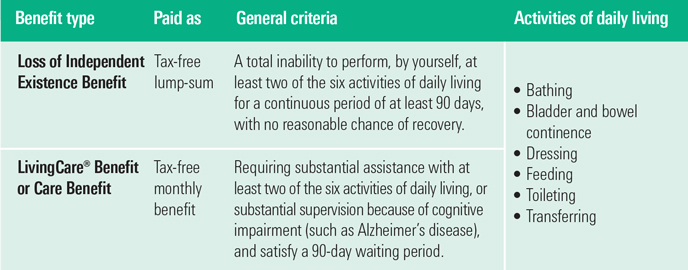

Optional Coverage for Long-Term Care – While each company’s products vary, CI policies may offer options such as:

Whether you are concerned about physical or financial changes if you were to face a critical illness or lose your independence due to illness, a CI insurance policy can help complete your financial plan to protect your wealth for yourself or future generations.

If you would like more information on critical illness insurance, please ask your Odlum Brown Investment Advisor or Portfolio Manager for our additional critical illness articles, or contact us through your advisor.

Odlum Brown Financial Services Limited (OBFSL) is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients. OBFSL offers a variety of coverage options from many of Canada’s top insurance companies tailored to suit clients’ individual needs. Our licensed professionals are here to help you assess your position and then implement customized recommendations to meet your individual circumstances and needs. For more information, please contact your Odlum Brown Investment Advisor or Portfolio Manager.