Planning Tips for Charitable Donations

By

Michael Erez,

CPA, CGA, CFP®

Vice President, Director,

Odlum Brown Financial Services Limited

By Debbie Stuart , CLU, CHS, TEP

Estate and Insurance Planner,

Odlum Brown Financial Services Limited

This month, we are pleased to share 10 tips to help you get the most value from your charitable donations:

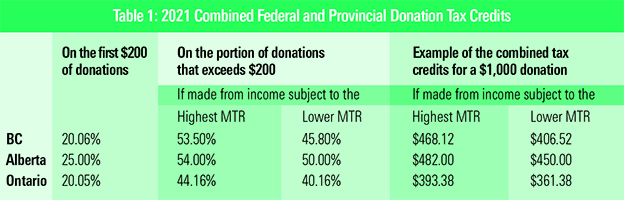

- By claiming receipts totaling over $200 on a single tax return, you save more tax. As illustrated in Table 1, the first $200 of charitable donations that are claimed on a single tax return receive a lower tax credit rate than the rate available on the portion of donations above this threshold.

- If you and your spouse or common-law partner combine donations on one tax return, you may reach the $200 threshold for a higher donation tax credit sooner. Donations can be claimed on either spouse’s tax return.

- Donations made from income subject to the highest marginal tax rate (MTR) receive higher donation tax credit rates. For example, any portion of donations over $200 that were made from income over $216,511 (federally) and $222,420 (provincially) for a BC taxpayer in 2021 can receive the higher tax credits illustrated in Table 1.

- Donation receipts can be claimed on a current tax return or carried forward up to five years. Tax credits for donations made in 2021 can be claimed on any tax returns from 2021 through 2026. By accumulating and claiming credits for receipts exceeding $200 on a single tax return, more of your donation dollars benefit from the higher tax credit rates.

- Consider donating eligible securities1 “in-kind” from a non-registered account rather than donating cash. In addition to receiving a donation tax credit based on the market value of your donation, you also benefit from not having to include in your income any capital gains on donations of eligible securities that have appreciated in value.

Let’s assume you have shares of XYZ Co., a publicly traded company, worth $5,000 that you originally purchased for $3,000. By donating XYZ shares directly to charity, you can eliminate a taxable capital gain without reducing your donation tax credit. Your estimated tax savings are shown below in Table 2.

- If you are considering making large gifts, including bequests upon death, seek professional tax advice on how to maximize the tax value of the gifts. The annual limit that can be claimed, for most types of donations,3 is 75% of net income for the year, except in the year of death or year before death, when the limit is 100% of net income.

- You can name a charity as beneficiary on your registered accounts. In contrast to making a charitable bequest in your will, designating a charity as beneficiary of a registered account such as an RRSP or TFSA enables a direct transfer from the financial institution holding the accounts to the charity upon your passing, bypassing your estate and probate. You can change the beneficiary designation at any time.

- You can donate life insurance. The three most common ways are:

- Name a charity as the beneficiary of an existing policy and claim the donation tax credit for the proceeds of the policy upon death. You remain the owner of the policy and can change the beneficiary during your lifetime. Because this arrangement is revocable, you do not receive any donation tax credits during your lifetime.

- Purchase and donate a new policy making the charity both owner and beneficiary of the policy. You pay for (and effectively donate) the ongoing premiums and receive a corresponding tax receipt annually. Under this irrevocable arrangement, you do not receive a tax credit for the death benefit ultimately paid to the charity.

- Transfer the ownership of an existing policy to a charity with the charity as beneficiary. This may be a good option if you no longer need the policy. As with donating a new policy, you receive annual tax receipts for the premiums you pay to keep the policy in force.

For transfers of existing policies, a tax receipt may also be available based on the value of the policy at the time of transfer. Consult with your tax and insurance professionals prior to transferring ownership of a

life insurance policy.

- Consider donating through a Donor Advised Fund. With a Donor Advised Fund (DAF), you establish a charitable fund by donating cash, securities and, depending on the fund, other assets like real estate, and receive an immediate donation tax receipt. The funds invested within the DAF are tax-exempt and, although irrevocable, you maintain involvement in advising which organizations and projects receive grants over time. For many donors, this arrangement serves as a valuable way to involve and engage family members in their philanthropic vision. Donors may also designate successor advisors to continue after their own death or incapacity.

- Consider donating through a public foundation. This could be done to establish an endowment or to effect more rapid grantmaking, whether during your lifetime or by bequest. Donation through a public foundation is also a practical option if you are considering a bequest to smaller charities that may not withstand the test of time or are undecided how you want to impact your community. By consulting with the public foundation of your choice in advance, you can often direct your bequest to areas of interest without needing to identify specific charities.

If you would like more information on charitable donation options, please ask your Odlum Brown Investment Advisor or Portfolio Manager for our additional charitable donation articles or contact us through your advisor.

1 Examples of eligible securities may include securities listed on prescribed stock exchanges, mutual funds, segregated funds of life insurance companies, and employee stock options that meet other criteria. Please obtain professional income tax advice.

2 Assumes that the full value of the donation tax credit is claimed on your or your estate’s eligible income tax returns.

3 The annual donation limit may increase to 100% of net income for gifts of ecologically sensitive land to a municipality or certain charity, or for “certified cultural property.”

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited, offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.