In “Human Nature 101,” the lead article in our April 2021 Odlum Brown Report, I shared a humbling experience about a pyramid scheme I fell for when I was at university. Despite a gut instinct that it was too good to be true, and a sound understanding of why such money-making systems collapse faster than most expect, I let envy, greed and the fear of missing out (FOMO) get the best of me – and my wallet.

The lesson was top of mind a year ago because uber-accommodative government and central bank policies were fueling a highly speculative market environment. Everyone seemed to have a neighbour, relative or friend with a “hot” investment idea with the prospect of supersized gains. While we didn’t think there was a general stock market bubble waiting to burst, we did declare a bubble in speculative areas of the market. We cited certain expensive and popular businesses, sectors and themes as the most worrisome. Among these vulnerable investments were Tesla, clean energy, Bitcoin, funds with returns of more than 100% in 2020 and initial public offerings (IPOs) that doubled in price on their first day.

We wondered what would happen to this speculative activity if, and more likely when, governments and central banks throttled back their extraordinary support for the economy. Would there be enough money – and investors – to maintain such lofty valuations?

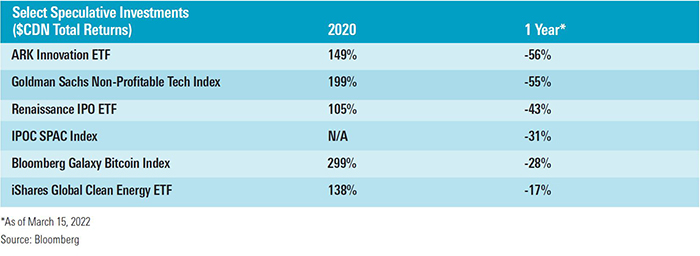

We now know the answer, and it isn’t pretty. Extraordinary government support payments have largely ended; the U.S. Federal Reserve and the Bank of Canada recently stopped injecting money into the financial system and started raising interest rates; and many, if not most, of the speculative investments that led the market in the first year of the pandemic have crashed. The table below highlights the boom/bust pattern with a sampling of returns for 2020 and the one-year period ended March 15, 2022, measured in Canadian dollar terms. Fast-growing, yet unprofitable, technology stocks have been among the hardest hit, with the Goldman Sachs Non-Profitable Technology Index yielding a loss of 55% over the last year.

If there was a fund manager to envy in 2020, it was Cathie Wood, whom I wrote about in February’s newsletter. Her ARK Innovation ETF owned many of the popular speculative growth stocks and returned close to 150% that year. But over the last 12 months the fund has lost more than half of its value as those stocks have come crashing back to earth. Canadian-listed Shopify, one of ARK’s largest holdings, briefly surpassed the Royal Bank of Canada as the most valuable company in the Canadian market, but it too has lost half of its value over the past year. Tesla is the one big holding in ARK’s portfolio to buck the trend, with a total return of 16% over the last 12 months. Other clean energy investments haven’t fared as well, with the iShares Global Clean Energy ETF shedding 17% of its value over the same period.

Once-hot IPOs have gone cold as well. The Renaissance IPO ETF, which holds a portfolio of the largest, most liquid newly listed U.S. IPOs, has produced a loss of 43% over the last 12 months. Food delivery company DoorDash illustrates the frenzy and the fall well. Its December 2020 IPO was priced at $102 and began trading at $182 on its first day as a public company. The stock peaked above $257 in November 2021 before retreating to roughly $80 in mid-March, a decline of almost 70% from its high.

Special Purpose Acquisition Companies, otherwise known as SPACs, brought high-profile companies like DraftKings, Virgin Galactic and Nikola public. They were all the rage in the second half of 2020 and into the first quarter of 2021, but investor interest has since waned alongside falling share prices. The IPOC SPAC Index has yielded a loss of 31% for the 12 months ended March 15, 2022.

Investor euphoria drove shares of lockdown beneficiary stocks like Zoom, DocuSign and Peloton to the moon in 2020, but those rockets are out of fuel. The trio produced an average loss of 71% over the last year, and all three stocks are back near their pre-pandemic levels.

Most things crypto-related have experienced a major drop in altitude as well; the Bloomberg Galaxy Bitcoin Index is down 28% over the last year.

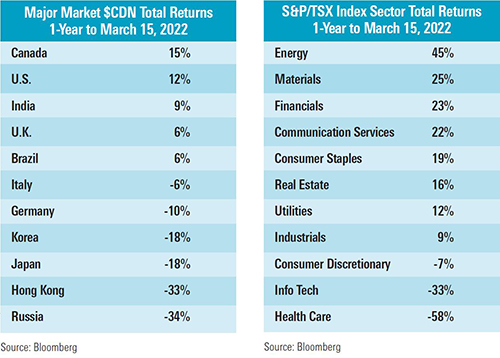

Here in Canada, cannabis stocks have flamed out spectacularly, with the weight of their poor performance dragging down the S&P/TSX Health Care Index to a 52-week loss of 58%. The S&P/TSX Information Technology sub-group was the second-worst-performing sector over the same period, down 33%, largely due to the drop in Shopify’s share price.

Fortunately for those who avoided the speculative pockets of the market and diversified their portfolios elsewhere, performance has been much better. In fact, Canada’s S&P/TSX Composite Index has led the world’s major equity markets with a one-year total return of almost 15%. Eight of the 11 major sectors have generated positive returns, aided by Energy, Materials and Financials with gains of 45%, 25% and 23%, respectively.

U.S. equities have also done well. Over the last 12 months, the S&P 500 Index is the second-best among major stock market bourses, returning nearly 12%. Impressively, that return was achieved without much help from the so-called FAANGM stocks (Meta, Apple, Amazon, Netflix, Alphabet and Microsoft), which returned an average of just 4% over the period.

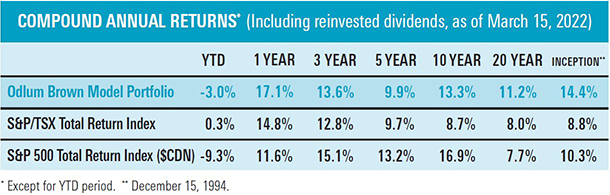

The Odlum Brown Model Portfolio1 has held up remarkably well despite heightened market volatility. As of mid-March, the portfolio was down 3% year-to-date, and up over 17% compared to a year ago. Our emphasis on reasonably priced, high-quality businesses and a diversified approach have served us well.

While a deeper and more broadly based equity market correction is a near-term possibility due to the uncertainty around inflation, central bank policies and the Russia-Ukraine war, we are more constructive than we have been in a while regarding the medium and long-term outlooks for the economy and for stocks.

Our positive view is supported by three important considerations. First, the cleansing that has occurred in the speculative areas of the market is a healthy development. It has reduced the market’s overall risk profile and enhanced aggregate return prospects. Second, central banks are finally taking the threat of persistently high inflation seriously, and are articulating a resolve to restore price stability. While that commitment might cause some near-term economic pain and stock market volatility, it greatly reduces the risk that inflation will undermine the foundation of the economy and asset values in the long run. Lastly, investor sentiment is broadly negative, with the CNN Business Fear & Greed Index2 oscillating between “Extreme Fear” and “Fear” in recent weeks. The upside prospects for stocks are always better when sentiment is subdued, as there is more scope for sentiment to improve. As Warren Buffett wisely once said, “Be fearful when others are greedy and greedy when others are fearful.”

1 The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.