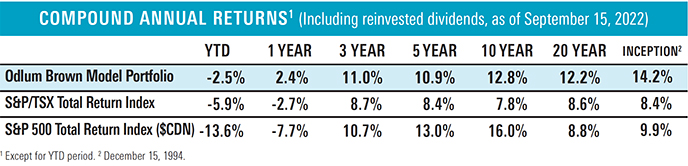

Despite the highest inflation in four decades, significantly higher interest rates and recession fears, the Odlum Brown Model Portfolio had a good summer. Over the three months ended September 15, 2022, the value of our all-equity Model appreciated by 6.5%. That reduced our year-to-date decline to 2.5%, which compares favourably to the 5.9% and 13.6% declines in the respective Canadian and U.S. equity benchmarks over the same period.

While the uncertainty around inflation, interest rates and the economy fuels wild volatility in asset markets and heated debates among pundits, it’s important to remember that investing is a marathon – not a sprint. It’s a long-term endeavour where diligence, diversification and patience pay off.

Before we address the path ahead, consider where we have been. Over the last two and a half years, the world has navigated the worst pandemic in more than a century. Before that storm hit, equities were doing very well; in 2019, the Canadian and U.S. equity benchmarks produced total returns in excess of 20%. Since then, they have appreciated 24% and 28%, respectively. That is pretty darn good considering the magnitude of the economic dislocations caused by the pandemic and the war in Ukraine.

The satisfying headline performance of the equity benchmarks over the last few years has masked very significant, and healthy, corrections in individual securities. Not only have many excesses been expunged from the market, but long depressed and neglected securities have experienced meaningful recoveries, too. The phenomenal performance of traditional energy firms is the most obvious example of the latter. Year-to-date, the top three gainers in our Model are Tourmaline Oil Corp. (119%), Cenovus Energy (62%) and Canadian Natural Resources (41%).

Both stocks and bonds have suffered this year, as central banks have increased interest rates to slow economic growth and bring inflation under control. While it’s unclear how much more rates have to rise, and how the economy may suffer in the near term, history and our experience have taught us to focus on individual businesses and their prospects over the next three to five years. It doesn’t help to obsess about politics, macroeconomics or what may happen next month or next quarter. Our success has always been driven by holding the best combination of businesses for the long term, rather than rotating in and out of the market or between sectors based on an economic forecast.

Indeed, we attribute our pleasing relative performance this year (and over the last few years) to a bottom-up, stock-by-stock focus on the fundamentals. Like blocking and tackling in football, it’s the discipline of executing well on the basics that tends to contribute most to long-term success, and not the sexy “Hail Mary” investments. Those basics are: (1) own great businesses; (2) don’t pay too much; (3) diversify; (4) focus on the long term; and (5) be patient.

There is no doubt that inflation is a threat to the economy and asset prices, which is why we are pleased that the authorities are taking appropriate action to ensure inflation is not a lasting issue. Investors are well aware of the economic risks associated with the battle against inflation, and we believe much of those risks are already discounted in share prices. While eradicating inflation will have a near-term cost, the normalization of interest rates at a higher, more natural level will also help establish a healthier economic foundation for the future.

We are focused on owning a combination of companies that are best equipped to survive economic turbulence and that can build bigger, stronger and more valuable businesses over our investment horizon.

Over the last three months, we executed a number of trades.

We added a new positon in The AES Corporation (AES); increased our weighting in both CAE Inc. (CAE) and PayPal Holdings, Inc. (PYPL) by 50%; swapped our position in Stryker (SYK) for a new one in Enovis Corporation (ENOV); trimmed our holdings of Tourmaline Oil Corp. (TOU), Intact Financial (IFC) and Apple Inc. (AAPL) by half a percentage point each; and sold Charter Communications (CHTR).

The AES Corporation is well positioned to benefit from the green energy transition. The company owns a diverse mix of utilities and renewable power generation assets, and is also a leading developer of energy storage solutions, which will help utilities optimize intermittent renewable power and source a higher proportion of grid electricity from renewables. New management has narrowed the company’s geographic and business focus by selling businesses in markets where the firm did not have a strong platform or competitive advantage. The company now has operations in fewer countries, a stronger balance sheet and a rapidly growing renewable energy business. With these positive attributes, together with the company’s plan to aggressively phase out coal by 2026, we believe there is meaningful scope for AES’s valuation to increase.

Both CAE and PayPal have performed poorly since we added them to the Model, yet we remain enthusiastic regarding the outlook for their respective businesses. The additional CAE and PayPal shares were purchased at discounts of roughly 40% and 15%, respectively, compared to our original purchase prices.

While we continue to like Stryker’s competitive position and long-term outlook, we believe Enovis has the potential to generate a better return. Enovis is a global leader in orthopedic care solutions, such as knee braces, medical walking boots and rehabilitation equipment. It also has a fast-growing surgical implant business including shoulder, knee, hip, foot and ankle replacements. The orthopedics market is growing as people age, sports become more aggressive and more people occupy the extremes of obesity and very active lifestyles. The company has been gaining market share in its key markets, and we believe the trend will continue. The company is creating innovative new products, servicing growing channels such as same-day surgical care clinics, and offering a growing range of products aimed at prevention, repair and recovery.

Tourmaline, Intact and Apple remain BUY-rated and meaningful positions in the Model, and we continue to be enthusiastic regarding their long-term prospects. We trimmed our position sizes for these three stocks and reallocated funds to businesses with better upside to our one-year targets.

We sold Charter Communications because the competitive landscape for broadband internet services has intensified. This development, together with the company’s relatively high level of financial leverage, an inflationary environment that is putting pressure on discretionary consumer spending and the possibility of an economic recession on the horizon, led us to conclude that there are better investments at this juncture.

Just as a single tackle doesn’t win the game, it’s unlikely that any of these individual trades will meaningfully move the performance dial. In aggregate, however, we believe they enhance the Model’s overall risk and return characteristics and improve the odds that our performance will outshine the benchmarks.

1 The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.