Estate and Incapacity Planning Documents

By Heather Rivers, BA, CFP®, FMA

Communications and Education Specialist,

Odlum Brown Financial Services Limited

What are they and where should I keep them?

As part of one’s holistic planning, it is important to address what would happen upon your death or if you were to become temporarily or permanently incapable of making your own health, personal care, financial or legal decisions. We highlight below some of the main planning tools that are available to BC residents to document their wishes.

As part of one’s holistic planning, it is important to address what would happen upon your death or if you were to become temporarily or permanently incapable of making your own health, personal care, financial or legal decisions. We highlight below some of the main planning tools that are available to BC residents to document their wishes.

Estate planning involves arranging in advance how your estate (what you own) will be distributed, and to whom, after you die. You can use several tools to create an estate plan, such as wills, trusts and joint ownership, as well as designating beneficiaries on life insurance policies and registered plans, such as retirement savings plans, registered pension plans and Tax-Free Savings Accounts.

Incapacity planning involves legal tools to communicate your wishes and instructions and appoint substitute decision-makers in the event that you become incapable of making or communicating important legal, personal, health and financial decisions yourself. These tools can include, for example, trusts, Representation Agreements (RAs) or Power of Attorney (POA) agreements.

Why do I need a will?

Without a will, someone must apply to the court to be appointed as the administrator of your estate, a process that can be time-consuming and costly. In BC, your estate would be distributed in accordance with the Wills, Estates and Succession Act (WESA), which may not reflect your intentions.

Even if you think your estate would be simple to administer, drafting a will can still offer advantages. It allows you to name who should act as your executor(s) and/or as guardian(s) for minor or disabled children; may help your executor access potential tax savings; may reduce the cost of administering your estate; and allows your executor to deal with assets according to your wishes. While some property can be distributed without a will, such as assets owned jointly with “right of survivorship”1 or assets for which you have designated beneficiaries, a will lets you indicate your preferences for dealing with other assets after your death, including business interests, digital assets such as your social media accounts, assets held in sole name or your interest in assets held as tenants-in-common.

Why do I also need incapacity planning?

Although a will comes into effect when you die, it does not appoint someone to act on your behalf while you are alive, even if you are incapacitated. Other legal tools, such as an RA and/or POA, allow you to plan ahead for a time when you may need assistance, by appointing someone to act on your behalf. If you fail to plan ahead, the process to legally appoint someone as your decision-maker (known in BC as a “Committee”) can add time and costs to an already difficult life moment.

If you plan ahead and appoint an “Attorney,” you can choose whether to allow them to make financial and legal decisions immediately and also whether to authorize them to continue acting if you lose mental capacity, which is known as an Enduring Power of Attorney (EPOA). A “Representative” whom you name in an RA can make decisions on your behalf after you lose capacity, or help you make decisions, including about your routine financial affairs, certain legal affairs, and – unlike an EPOA – personal or health care (such as your living arrangements, diet or home support). You have the option to appoint a monitor in an RA, to help oversee the decisions your Representative makes.

What happens after your documents are created?

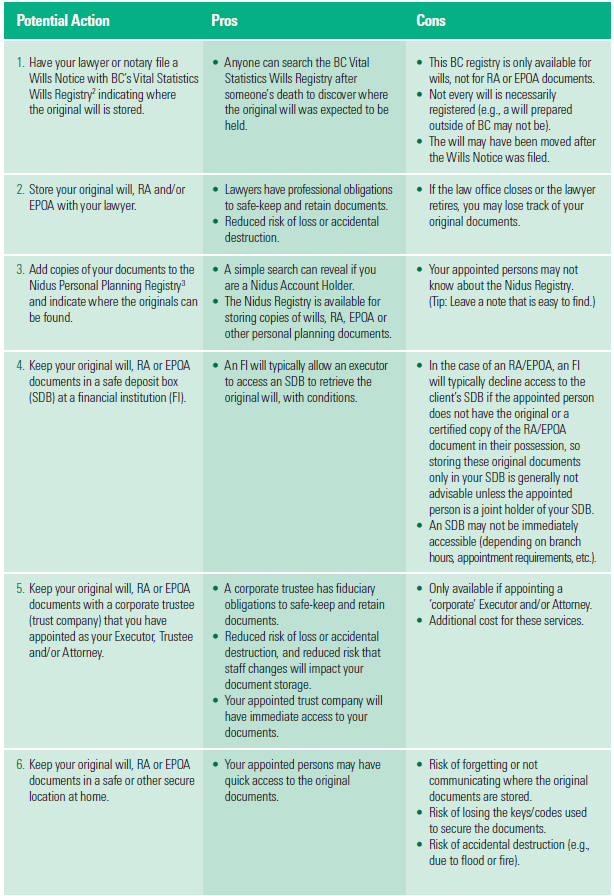

Making a will, RA or EPOA document can be futile if these documents cannot be found when needed. Here are some options to make it easier for your appointed persons to access your documents.

TIP: Your BC RA or EPOA documents must be printed and stored as physical documents, not stored online. A BC will can now be an electronic will, but seeking legal advice about the pros and cons of electronic wills is strongly recommended.

Odlum Brown Financial Services Limited (OBFSL) neither prepares legal documents nor provides legal advice. Clients should consult with their legal professional(s) before acting on any matters discussed in this article, to obtain advice on planning for their future estate or incapacity.

Additional Resources:

“It’s Your Choice – Personal Planning Tools” http://www.trustee.bc.ca/documents/STA/It's_Your_Choice-Personal_Planning_Tools.pdf

“Wills and Estates” https://www.peopleslawschool.ca/publications/wills-and-estates-collection

“My Voice – Advance Care Planning Guide” https://www2.gov.bc.ca/gov/content/family-social-supports/seniors/health-safety/advance-care-planning?keyword=My&keyword=Voice

“Incapacity Planning” https://www2.gov.bc.ca/gov/content/health/managing-your-health/incapacity-planning

“When I’m 64: Controlling Your Affairs” https://www.peopleslawschool.ca/publications/when-im-64-controlling-your-affairs.

Additional OBFSL articles, including “Choosing an Executor,” “Pre-Planning for Incapacity and Death,” “Getting Organized – A Proactive Guide to Preparing for Illness, Injury or Death” and an “Executor Checklist,” are available on the online Odlum Brown Client Centre or through your Odlum Brown Investment Advisor or Portfolio Manager.

1 For more information on joint ownership, see our article “Joint Ownership in Estate Planning” available on the online Odlum Brown Client Centre or through your Odlum Brown Investment Advisor or Portfolio Manager.

2 For more information about using BC’s Vital Statistics Wills Registry, see http://www.clicklaw.bc.ca/resource/2055.

3 For more information about using the Nidus Personal Planning Registry, see https://www.clicklaw.bc.ca/resource/2543 and https://nidusregistry.ca/.

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited, offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients.