As the Canadian banks reported their results for the first quarter of 2023, attention was squarely on the implications of higher interest rates, particularly in real estate lending. Then the failure of Silicon Valley Bank (SVB) cast renewed attention on liquidity and funding risks for the banking sector worldwide. Fortunately, the big six Canadian banks (Royal Bank of Canada, Bank of Montreal, TD Bank, Scotiabank, CIBC and National Bank) operate quite conservatively relative to global peers, which should help them navigate whatever storms come their way.

The Canadian Banks are Very Different From SVB

Last month’s collapse of SVB came as an absolute shock to the banking community, but the causes of the failure were quite straightforward. The bank’s deposits had been declining throughout 2022 as venture capital-backed firms were burning through cash and struggling to raise additional funding. Meanwhile, the bank had a large securities portfolio, which it was forced to sell at a loss to fund deposit outflows. After the bank announced a large securities sale and an equity raise, venture capital firms smelled weakness and frantically encouraged their portfolio companies to withdraw deposits.

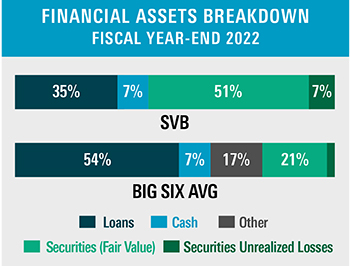

The episode shone a spotlight on SVB’s securities portfolio, which had significant unrealized losses. Part of these were excluded when calculating total assets but became a serious problem during SVB’s final days. Fortunately for the Canadian banks, this dynamic does not exist to nearly the same extent, as they have smaller securities books with minimal unrealized losses.

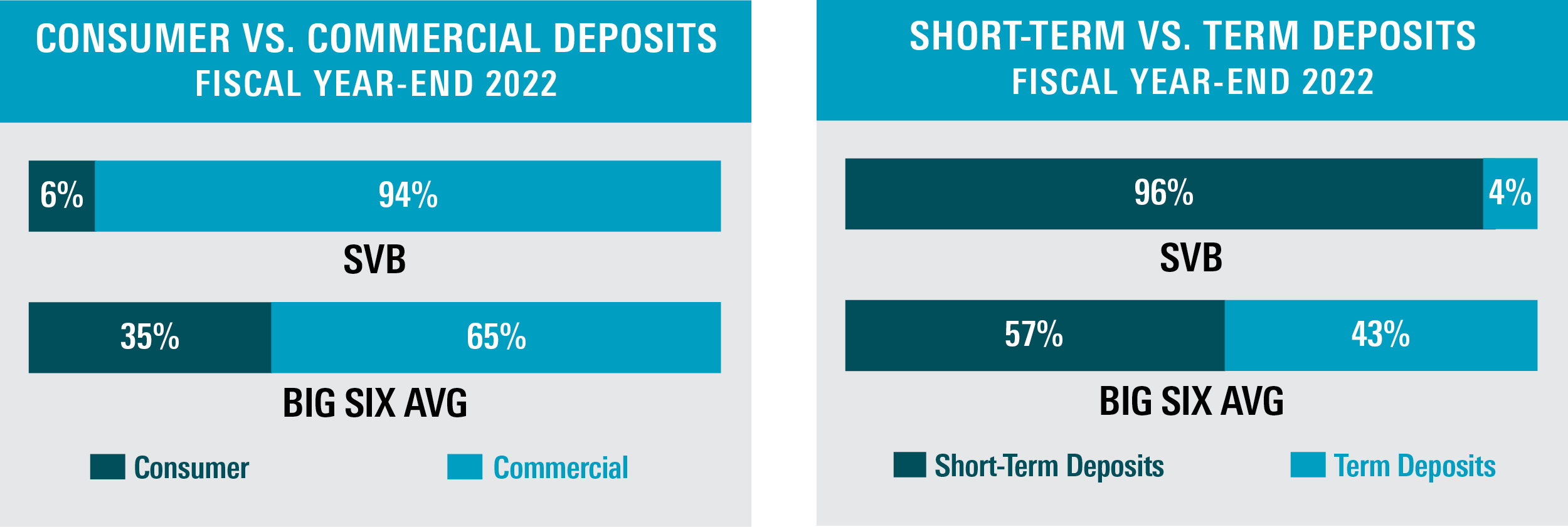

That being the case, SVB’s demise was more a function of its liability profile than its securities portfolio. Because the bank’s deposits were heavily concentrated among venture capital-backed firms, there was greater scope for them to behave in a herd mentality. Furthermore, these deposits were almost all ineligible for Federal Deposit Insurance Corporation (FDIC) protection (at the time), so depositors were especially motivated to withdraw their money before losing it. Making matters worse, the vast majority of SVB’s deposits were redeemable on short notice.

Conversely, the Canadian banks have very different deposit profiles. They have a much larger weighting toward consumer and term deposits, which drastically lowers the odds of a bank run. A large chunk of those consumer deposits would qualify for Canada Deposit Insurance Corporation (CDIC) protection, which gives depositors additional peace of mind and limits the incentive to withdraw in a panic. Also, the commercial deposits are significantly more diversified by industry and geography, which means clients are unlikely to act with such a herd mentality.

Perhaps most importantly, the Canadian banks are designated as Domestic Systemically Important Banks (D-SIBs), which means they are subject to considerably more stringent capital and liquidity requirements. It also implies that they are considered too big to fail. While any government bailout would be costly for shareholders, the implicit government backing should provide a sense of security for depositors and help prevent a repeat of SVB’s fate.

Credit: All Eyes on Real Estate Lending

After eight quarters of improving loan quality, the big six Canadian banks saw their gross impaired loans (GIL) ratio, which measures the proportion of loans unlikely to be paid back fully, increase for the second quarter in a row. This is partly because the GIL ratio was unsustainably low, and notably this number is still well below pre-pandemic levels, and management teams have been repeatedly referring to credit “normalization.” Yet it is clear that economic conditions are becoming more ominous, and some borrowers are getting squeezed by higher rates.

The Canadian economy has been buoyed by real estate for decades, and, as a result, Canadians have built up very high debt levels underpinned by strong real estate values. In the past, low interest rates made such debt levels manageable. But in today’s environment, more borrowers are coming under strain, particularly those with variable-rate mortgages. A recent CIBC filing revealed that 20% of its mortgage borrowers are seeing their balances grow because the fixed monthly payment is insufficient to cover the variable interest rate. Borrowers with fixed-rate mortgages are better off for the time being but will face higher payments upon renewal. Data released this quarter by BMO, CIBC and NBC indicate that 11-13% of total mortgages will be renewing in the next 12 months.

Despite these worrying trends, the banks anticipate minimal credit losses from residential mortgages. Most residential loans are either insured, made to very high-quality borrowers, are well collateralized, or a combination thereof. That said, the Canadian banks must not be complacent, nor rely on a strong real estate market to contain credit losses. Any pain experienced by mortgage borrowers could lead to unprecedented losses for mortgage lenders, and there could be knock-on effects for the Canadian economy, which would undoubtedly lead to additional losses in the banks’ other loan categories.

The Big Picture: Compelling Long-Term Investments, but with Cyclicality

The pandemic in 2020 and the recent bank failures are reminders of how cyclical the banking industry can be. Yet Canadian bank fundamentals remain strong. All of the big six have enviable market positions, sturdy underlying profitability and ambitious medium-term growth targets. They generally have solid track records relative to smaller Canadian banks and banks in other countries. Canadian banks deserve credit for their resiliency during the pandemic, and they remain one of the best places to find yield among TSX-listed equities. Economic risks have grown, and we expect some near-term pressure on earnings. Fortunately, the banks are well positioned, both operationally and financially, to weather the economic bumps ahead. Moreover, the recent weakness in the share prices is likely discounting these challenges.

Customary Risk Considerations

Investment risks include: (1) the banks operate economically sensitive businesses and, as such, the strength of the Canadian economy, and other economies where the banks operate will have a material influence on earnings; (2) the banks operate in a competitive industry and increased competition could have a negative influence on earnings, which in turn, would likely have a negative impact on share prices; (3) a sustained decline in equity markets would have a negative impact on operating results; (4) the banks are involved in litigation, which could have a material negative impact on earnings and financial position; and (5) bank share prices are sensitive to changes in interest rates.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.