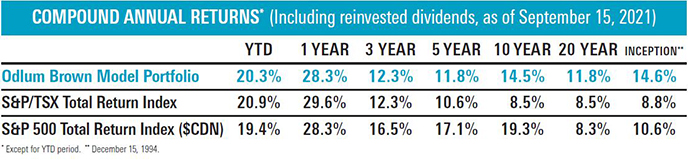

The Odlum Brown Model Portfolio1 had a good summer, appreciating by 6.4% over the three months ended September 15, 2021. That brought the year-to-date gain to a little more than 20%, which is in line with a blended 50/50 Canadian and U.S. benchmark.

The so-called “growth” stocks like Microsoft and Costco that did so well in pandemic lockdowns were again among the Model’s top-10 performers in the latest quarter. Many of these stocks continue to bump up against our price targets at higher and higher valuations, yet they are the ones driving performance. This poses a conundrum when considering the added risk that comes with paying higher prices. The margin of safety and prospective returns are naturally lower when valuations are higher, yet it’s also comforting to own high-quality businesses that are performing well in an uncertain world.

When the global economy began to reopen and vaccination rates rose, there was a noticeable shift in the market’s leadership. Value-type stocks, those hit hardest by lockdowns, started to outperform the high-quality growth businesses, and many wondered if it was the beginning of a long-term trend. However, the rotation was short-lived, and value stocks have lost altitude since early May as concerns about the Delta variant have intensified.

Fortunately, the Model is reasonably balanced between the two groups. Many of the Model’s value laggards have greater return potential and, arguably, a better margin of safety. At the same time, we have a decent contingent of high-quality growth businesses with excellent fundamentals and satisfying stock performance. We continue to make modest shifts in the portfolio’s composition to take advantage of market volatility and position the Model for better long-term performance.

We have long counselled the merits of holding great businesses for the long term, and we generally stand by that advice. However, history teaches that the biggest and best businesses aren’t always the best stocks. The strategy loses efficacy when great businesses become too popular and pricey. This normally happens after a long period of strong business performance and valuation multiple expansion. It’s also when investors feel most comfortable. After all, it’s counterintuitive to sell a winning stock that has outperformed for a decade or more.

Consider what came to be known as the Nifty Fifty group of premier growth stocks, such as Xerox, IBM, Polaroid and Coca-Cola, in the early 1970s. They had performed so well as businesses and as stocks that they were often called one-decision stocks: buy and never sell. Investors soon regretted the confidence and comfort they had in these richly priced businesses, as the stocks crashed when inflation accelerated later in the decade. A similar thing happened with technology and other great American blue chip businesses in the late 1990s. After an extended period of outperformance, valuations became so stretched that they had nowhere to go but down; it took many of those popular stocks more than a decade to regain their highs after valuation multiples corrected from extreme levels.

The lesson from history is that price matters. Sometimes it makes sense to sell winners to make room for businesses with better risk and return attributes. The challenge is timing. Cycles tend to run longer than expected, and shifting strategy prematurely can result in poor short-term performance.

Nonetheless, with sentiment and valuations of great businesses today reminiscent of the attitudes and prices paid in the early 1970s and late 1990s, we are gradually and selectively shifting funds to investments that we believe have better long-term risk and return characteristics. Selling winners to buy laggards is uncomfortable, but we believe the better prices we get from executing unpopular trades will yield good results.

Over the last quarter, we swapped our interest in BCE Inc. for a new position in Charter Communications, Inc., and sold a little more than 40% of our position in Albemarle Corporation and our entire stake in Costco Wholesale Corporation to create room for TransDigm Group and CAE Inc. and to increase our holding of Fiserv, Inc.

While BCE provides an attractive dividend yield, we believe Charter will provide better total returns in the long run, as its underlying businesses have greater growth potential. Charter is the second-largest cable company in the U.S., providing cable television, broadband internet and telephone services.

Albemarle has a very bright future as a leading producer of lithium used in the batteries that power electric vehicles. Yet, with the value of our position almost tripling in less than two years, we felt it was prudent to crystalize some profit and reallocate the funds to other investments.

When we initiated coverage of Costco in May 2019, we thought the company could grow earnings at a compound annual rate of 8% over the next two years. Instead, the company doubled that pace because of COVID-19 lockdowns, which caused members to stock up and stay home. Analysts are optimistic that the better-than-expected results will persist, predicting that earnings will continue to compound at an annual rate of 16% over the next two years. With faster growth, Costco’s price-to-earnings valuation multiple has increased from about 30x current year earnings to 43x. Together, the combination of impressive earnings growth and valuation multiple expansion has caused the stock to appreciate by close to 90% since we launched coverage. We still love the business and the company’s long-term prospects, but worry that the stock might be priced for a growth rate that is unsustainable. As the world normalizes, businesses that were hurt by lockdowns will likely benefit at the expense of those that were helped by people staying at home.

CAE and TransDigm are aerospace businesses that will definitely benefit as people get out of their homes and resume travelling. The stocks experienced huge recoveries as the world started to open up, but both retreated as some cancelled travel plans due to the Delta variant. We believe this is a temporary setback, and we expect travel to increase considerably over the next few years.

With more than 160 facilities in over 35 countries, CAE provides training products and services to the civil aviation, defence and healthcare markets. While recognized for its full-flight simulator products, over 60% of CAE’s business is derived from the provision of services, largely under long-term agreements with airlines, business aircraft operators and defence forces. The company’s earnings, cash flows and balance sheet should improve materially as global air travel resumes, and that in turn should yield a much higher share price.

Chances are that the next aircraft you ride uses parts developed by TransDigm. These parts are critical to the performance of the airplane and require regular replacement, providing TransDigm annuity-like revenue streams in the aftermarket business. Once these parts are engineered into the aircraft, they are not easily substituted. As a result, TransDigm is frequently the sole-source provider for many of its aftermarket products. Competition is also limited due to strict regulatory and technical requirements, as well as the small market each unique part commands. Over the next few years, as volumes recover and people become comfortable with flying again, we expect TransDigm’s earnings and cash flows to grow considerably.

Finally, we increased our holding in Fiserv by 60%, as the stock has languished despite impressive improvements in the company’s underlying businesses. The company is a leading technology provider for banks and credit unions, with offerings spanning account processing, bill payments, digital banking and many other core banking functions. Fiserv’s offerings are critical for their clients’ businesses, and relationships tend to be very long lasting. Approximately 85% of revenue is recurring, and demand should remain strong for many years as consumers continue to expect better technology from their banks.

Although it may seem counterintuitive to some, we believe that shifting profits from some of our high performers into laggards at lower valuations and with better long-term growth potential will lead to results that may surprise the crowd.

1 The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.