Withstanding Inflation

Friday, June 25, 2021

A McDonald’s in Tampa, Florida, struggling to find labour, is offering job applicants $50 just to show up for an interview. Homebuilders have seen lumber prices shoot higher. Groceries are getting more expensive. The U.S. Consumer Price Index, a broad measure of consumer prices, rose 5% in May, its highest rate of increase since 2008. In Canada, consumer prices are rising at their fastest pace in nearly a decade. Tangible examples of inflation abound.

What’s less evident is whether current inflationary forces are transitory or if they will prove to be more problematic. It’s an important investment question. After all, rising inflation can crimp corporate profit margins, slow economic growth and motivate central banks to increase interest rates – all of which could negatively impact stock prices.

We have no clear view on how much inflation will rise. In fact, there are strong arguments that suggest deflation remains a risk. Nevertheless, with inflation on the minds of many, we are evaluating which stocks will likely perform best in a rising-price environment.

In general, investors should temper their return expectations and consider how to best withstand the challenges that come with higher inflation. Gold and other commodities have historically offered some protection, but this piece focuses on the merits of owning quality companies, which we define as highly profitable businesses with the ability to raise prices without losing customers. This ability is called pricing power.

The appeal of pricing power is pretty straightforward. If a company can raise prices to offset higher input costs, it can better maintain its profit margin. But that alone isn’t enough to make a good investment. How much we pay for a quality company is an important factor. In many cases, the market has already recognized the positive attributes of quality companies, and valuation multiples are elevated. History teaches that paying an excessive price, even for high quality, is not a path to investment success. Remember the late 1990s? Wonderful businesses like Coca-Cola and Microsoft traded at steep valuations, and their stocks subsequently delivered poor returns in the decade that followed.

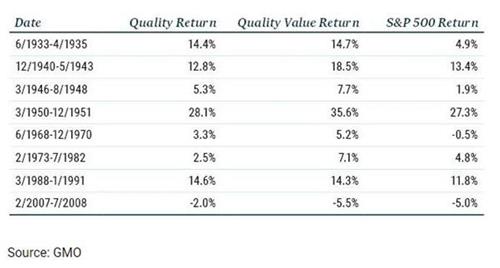

GMO, a U.S.-based asset management firm, recently shared the results of an interesting study. Looking at data over the last 100 years, GMO identified eight periods in which U.S. consumer prices rose more than 5% for a year or longer. Then they looked at the annualized stock performance of three broad categories: quality, attractively valued quality and the S&P 500.

Quality stocks outperformed the S&P 500 in six of the eight periods of inflation – a good result. Now look at Quality Value; it outperformed the S&P 500 in seven out of the eight periods and outperformed Quality six out of eight times.

The 1970s is of notable interest. Aside from being a period of prolonged inflation, the early 1970s marked the peak of the Nifty Fifty. The Nifty Fifty refers to a group of large, high-quality companies, like McDonald’s and Walt Disney, that traded at very high valuation multiples. As a group, the Nifty Fifty underperformed the market in the mid-to-late seventies. Similarly, GMO’s table shows that Quality underperformed during that same period. This underperformance wasn’t because the attractive attributes of these companies had gone away, but because the starting valuations were too high. Attractively priced Quality Value, on the other hand, outperformed.

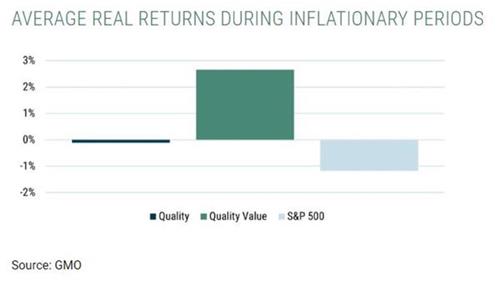

It is worth noting that the figures in GMO’s table are nominal returns – that is, they are not adjusted for inflation. GMO also looked at real returns, which measures nominal return minus inflation. Interestingly, as shown in this next chart, Quality Value was the only group that delivered a positive real return over the combined inflationary periods studied.

Overall, the returns in this study don’t look all that bad, a reminder that time tends to be an equity investor’s friend. However, let’s not forget that there were some pretty gut-wrenching sell-offs during these periods. The S&P 500 fell by nearly 50% in 1973-74 and took several years to recover. Stocks are long-term investments. We expect them to deliver decent returns over time, but they are subject to short-term bouts of very challenging volatility.

Inflation has risen in recent months, and there’s no way of knowing how long that will last. If sustained, it would likely be a meaningful headwind for stock prices. History suggests that quality businesses hold up well, but the price investors pay matters. At Odlum Brown, we strive to find reasonably priced, high-quality businesses – whether we’re in inflationary times or not – and we take some comfort knowing that this strategy has withstood inflation relatively well in the past.