Stocks Surprisingly Rally on Russian Invasion of Ukraine

By

Murray Leith CFA, Executive Vice President & Director, Investment Research

Thursday, February 24, 2022

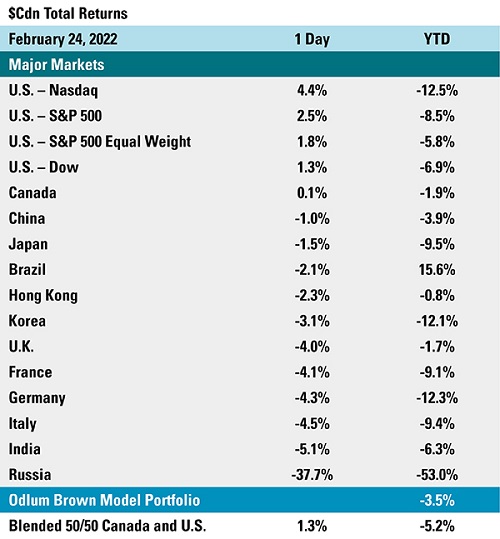

We watched the news of Russia’s full-scale invasion of Ukraine last night in horror. Not surprisingly, overseas stocks were immediately hit hard and North American equities underwent a major drubbing in the morning. Stocks in North America then staged one of the biggest intra-day rallies on record. The table below shows total returns for the day and the year-to-date (YTD) for the world’s major stock markets, measured in Canadian dollar terms.

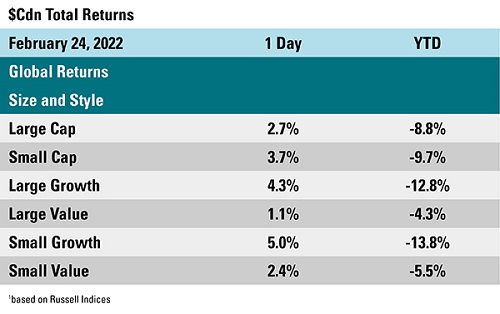

Russian stocks plunged nearly 40%, bringing their YTD loss to 53%. The broadly based S&P 500 Index ended the day up 2.5% and the technology heavy Nasdaq Index was up an impressive 4.4%. Growth stocks, large and small, were the biggest winners of the day, rising 4.3% and 5%, respectively, as highlighted in the second table. The worst-performing stocks for the YTD leading up to the invasion produced the largest rebounds. Canadian stocks ended the day roughly flat, with a gain of 0.1%. Despite big increases in oil and gas prices, our Energy stocks didn’t do much, and poor performance by our largest banks largely offset gains in other stocks. It was a day for growth stocks, and unfortunately the Canadian market is more geared to value stocks.

After seeing the remarkable recovery in stock prices, we went searching for an explanation, but didn’t find a good one. Interest rates moved down a bit, but not materially enough to justify an outsized jump in stock prices. Inflation expectations for the next few years rose somewhat, but looking out beyond five years, they remain very close to the central bank’s 2% target. Expectations that the U.S. Fed Funds rate will increase didn’t change much either. Traders have taken the possibility of a 50 basis point rate hike off the table for the March FOMC meeting, which could explain a bit of the strength.

North America has minimal direct economic exposure to Russia and Ukraine, although it is indirectly exposed via the possibility of higher commodity prices. Europe has much greater economic risk, principally due to its significant reliance on Russian oil and gas. The West is penalizing Russia with sanctions, but as it stands so far, they exclude commerce that would be most crippling to the Russian economy. The sanctions to date excluded exports of oil and agricultural products. Not surprisingly, the European countries most reliant on those commodities are against such sanctions.

On balance, it’s likely that the Russian-Ukraine war will modestly undermine global economic growth, and perhaps investors think that is good news as it could take the edge off inflationary pressures. Frankly, the effect on supply chains and consumer price inflation is uncertain, from our perspective. On the one hand, higher commodity prices and supply disruptions could contribute to persistently high consumer price inflation. On the other hand, if commodity inflation is significant enough and supply issues are material, the combination could tip the global economy toward recession. We don’t think that will happen, but it is a possibility.

We have long stressed the importance of owning high-quality businesses and having well-diversified portfolios due to the elevated risks and uncertainty in the world. The sad events of the last 48 hours reinforce that view. We own great businesses that are well positioned to weather the uncertainty ahead. The vast majority will continue to build bigger and stronger businesses, and be more valuable down the road. Investors who hold great businesses though the inevitable ups and downs, usually end up doing better than those who try to jump in and out of the market. Our advice is to brace for near-term volatility and expect positive results in the long run.

To support those affected by the events in Ukraine, Odlum Brown has made a special donation of $25,000 to the Canadian Red Cross Ukraine Humanitarian Crisis Appeal. +Learn More