After filing your income tax return each year, the Canada Revenue Agency (CRA) issues a Notice of Assessment (NOA) that includes your RRSP Deduction Limit Statement. Your RRSP limit is also available online through CRA’s My Account and the MyCRA mobile app.

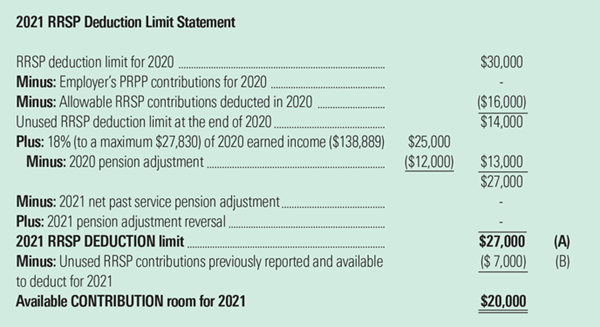

The statement shows how much you are entitled to contribute and deduct for the upcoming tax year and whether you may have over-contributed. Let’s look at an example statement for 2021 that an individual taxpayer received with their 2020 NOA if they earned income of $138,889 and belonged to a registered pension plan.

How much can I CONTRIBUTE to my RRSP?

Your maximum contribution = [RRSP deduction limit for the year (A)] – [Unused RRSP contributions (B)]. Contribution room you do not use in 2021 can be carried forward to use in any future year, if contribution age limits are met.

If (A) – (B) is negative (an amount shown in brackets), then you have no 2021 RRSP contribution room and may have an over-contribution. Negative amounts that cannot reasonably be expected to be deducted in future years or that exceed $2,000 (or exceed $8,000, if arising from a past service pension adjustment) at any time in the year may be subject to a penalty of 1% per month until withdrawn.1

Using the example above, the taxpayer could contribute up to $22,000 ($20,000 + $2,000 over-contribution) for the 2021 tax year without penalty. The $2,000 grace amount for over-contributions is not immediately tax-deductible and will be included as unused RRSP contributions (B) on the next RRSP limit statement.

What are unused RRSP contributions?

Unused RRSP contributions, denoted as (B) above, are contributions made in previous years that have not been deducted on your income tax return. You may contribute amounts within your contribution limit, but choose not to deduct your contribution in a given year, if you:

- have excess funds available;

- would like to defer tax on income earned within the RRSP as soon as possible; and

- expect higher taxable income in future years, against which an RRSP deduction may be more advantageous.

In the example above, the taxpayer made $7,000 worth of contributions in previous years that have not yet been deducted from income.

How much can I DEDUCT on my tax return?

Your RRSP deduction limit for 2021 is the maximum amount that you can deduct on your 2021 tax return, referenced as (A) on your statement.

Using the example above, the taxpayer could deduct a maximum of $27,000 (A). They could do this by deducting all $7,000 of their unused previous years’ contributions (B), as well as making and deducting a new $20,000 contribution.

Company Pension Plans

Contributions to a pension plan give rise to a pension adjustment (PA), which reduces your RRSP deduction limit for the following year. In our example, the PA from 2020 reduces the deduction limit for 2021.

Certain other pension transactions reduce or increase your current year’s deduction limit. A past service pension adjustment (PSPA) in 2021 will reduce your 2021 limit and a pension adjustment reversal (PAR) in 2021 will increase your 2021 deduction limit.

Group RRSPs and Pooled Retirement Pension Plans (PRPPs)

All contributions to group RRSPs or PRPPs by you or your employer will reduce your RRSP deduction limit for the current year. Be careful to consider all employer and personal contributions to group RRSPs, PRPPs and personal RRSPs to avoid over-contributing in the current year.

Employer group RRSP contributions are included in your income, but can be offset by tax deductions available on contributions. Employer PRPP contributions do not impact your taxable income for the tax year, since they are neither included nor deducted from taxable income. Your own group RRSP and PRPP contributions are deductible from taxable income.

Odlum Brown Financial Services Limited is a wholly owned subsidiary of Odlum Brown Limited offering life insurance products, retirement, estate and financial planning exclusively to Odlum Brown clients. Contact us through your Odlum Brown Investment Advisor or Portfolio Manager for more information.