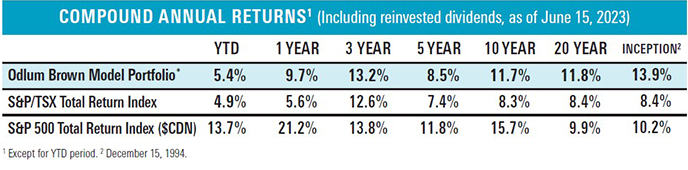

Investor sentiment and equity valuations, particularly in the United States, have improved meaningfully. From mid-June 2022 to mid-June 2023, the main Canadian and U.S. equity benchmarks appreciated by 5.6% and 21.2%, respectively. Over the same period, the Odlum Brown Model Portfolio* advanced 9.7%.

Not only have U.S. stocks outpaced Canadian stocks, and our Model, by a considerable margin this past year, but the same is true over longer horizons. Over the last 10 years, the S&P 500 Total Return Index ($CDN) has compounded at an impressive 15.7% annual rate, almost double the comparable 8.3% for the Canadian S&P/TSX Total Return Index and four percentage points better than the Model’s 11.7% annual gain.

Investors naturally wish they owned more U.S. stocks, and some clients have understandably asked if a low-cost S&P 500 Exchange-Traded Fund (ETF) would be a better alternative to our Model, which has been roughly equally balanced between Canadian and U.S.-listed securities over the past decade.

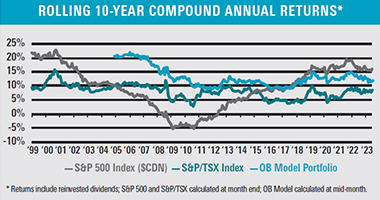

It’s a fair question and is reminiscent of client sentiment at the turn of the century. Then, as has been the case recently, U.S. stocks were doing much better than Canadian stocks. In fact, in Canadian dollar terms and including dividends, U.S. stocks compounded at a 20.9% annual rate in the 1990s versus 10.6% for Canadian stocks. While our Model had performed respectably since inception in December 1994, it wasn’t keeping pace with the American market because it was heavily skewed toward Canadian stocks, which we felt offered much better value.

Being skeptical about U.S. stocks and positioning the Model in better-valued Canadian stocks yielded a huge payoff in the 2000s. Not only did the technology bubble burst, but the excessive valuations of the large growth stocks that dominated the S&P 500 Index deflated as many Canadian stocks recovered smartly from depressed levels.

While investors are regularly warned that past performance does not guarantee future performance, it’s human nature to extrapolate trends. Those who expected U.S. stock outperformance to continue were massively disappointed. A decade later, at the end of 2009, the rolling 10-year annual return for the U.S. equity benchmark fell to -4.0%. A Canadian who bought an S&P 500 Index ETF would have lost 30% of their money in the 2000s, measured in Canadian dollars and before fees.

While investors are regularly warned that past performance does not guarantee future performance, it’s human nature to extrapolate trends. Those who expected U.S. stock outperformance to continue were massively disappointed. A decade later, at the end of 2009, the rolling 10-year annual return for the U.S. equity benchmark fell to -4.0%. A Canadian who bought an S&P 500 Index ETF would have lost 30% of their money in the 2000s, measured in Canadian dollars and before fees.

In the mid-2000s, as the China-fuelled commodity boom was accelerating and Canadian stocks were performing much better than U.S. equities, we started to shift considerable funds south of the border. The valuation multiples for America’s leading companies were a fraction of what they were in the late 1990s, and we were confident that the stage was set for an impressive recovery.

As it turned out, we were right, but we were also early. The relative valuations of America’s biggest and best continued to contract, despite generally growing their earnings at above-average rates. The downward pressure on valuation was so extreme that many of these companies traded at below-average multiples in the aftermath of the 2008-2009 Great Financial Crisis. That wasn’t logical. These were companies with significant competitive advantages, above-average profits and growth runways, and superior capital structures. It was a trying time, and a reminder that sentiment and valuations swing like a pendulum, from one extreme to another.

Fortunately, the lesson learned from our premature enthusiasm for U.S. stocks inspired even more conviction for a grand recovery as the pendulum swung back from undervalued to fair value and ultimately to overvalued once again. We outlined our case in a lengthy July 2009 report titled “We’ve Seen This Play Before: It’s a Story of Excessive Valuations, Subsequent Disappointment and Missed Opportunities.” In the report, we quoted Arnold Van Den Berg from the August 30, 2006, issue of Outstanding Investor Digest:

“From its 1973 peak to its 1981 low, Coca-Cola’s stock went from $75 to $30.50. That’s a 59% drop in the stock price. But the company wasn’t exactly standing still during those eight years. During that time, Coca-Cola’s sales went from $17.94 per share to $47.64 – which is an increase of 166%. Its earnings per share went from $1.80 to $3.62 – an increase of over 100%. And its dividend went from $0.90 to $2.32 – 158% increase. Meanwhile, its P/E [price-to-earnings multiple] went from 42 to 8 – which is a decline of 80%. Just think about that. The company’s earnings per share rose 101% and its sales per share rose 166% – and yet, eight years later, its stock was 59% lower.

Once a major company’s stock has been pummelled, and then it goes sideways for years, and its sales and earnings continue to build up, eventually, the stock price has to shoot up – like a cork out of a bottle. That’s exactly what happened with Coca-Cola’s stock…”

Coca-Cola’s share price didn’t just pop. It exploded. From its low in 1981 to its high in 1998, its share price went up more than 67-fold.

Coca-Cola’s story was not unique. A collection of stocks, which came to be known as the “Nifty Fifty,” followed the same pattern: a long period of superior performance culminating in excessive valuation, followed by a lengthy period of disappointment and underperformance, which set the stage for another lengthy period of superior performance.

In our 2009 report, we argued that the same pattern was unfolding again. After a decade of poor performance, we felt large-capitalization American stocks were poised to do very well, and history has proven our prediction correct. Those businesses have grown at above-average rates, with valuation multiples and dividends expanding considerably along the way.

Today’s price-to-earnings multiples for America’s largest growth companies are not as extreme as they were for the Nifty Fifty in the early 1970s, nor are they as lofty as they were at the turn of the century, but they are far from cheap. These companies are well loved by investors, and many are priced on the high side of reasonable. While the sentiment and valuation pendulum may still swing higher, we can say with confidence that the risk and reward proposition is nowhere near as attractive as it was five years ago or 10 years ago, or, even more so, when we issued our report in 2009.

Quality is paramount in our uncertain world, and for that reason we still have stakes in America’s biggest and best. Still, we have scaled back our exposure in favour of businesses that offer a better long-term trade-off between price and growth. Making this shift to less fashionable stocks has contributed to our recent underperformance, and we are certainly feeling some déjà vu.

Patience was required when we favoured Canadian stocks in the late 1990s, and it proved necessary when we started making meaningful investments in America’s biggest and best in the mid-2000s. But just as patience yielded rewards in those periods, we think a willingness to dial back exposure to popular American growth stocks and endure the possibility of underperforming in the near term will be a winning long-term strategy. With elevated valuations, the odds are not good that American growth stocks will be top performers over the next decade. We’d rather be selective than own a pricey S&P 500 ETF.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

The Odlum Brown Model Portfolio was established on December 15, 1994, with a hypothetical investment of $250,000. The Model provides a basis with which to measure the quality of our advice. It also facilitates an understanding of how we believe individual security recommendations could be used within the context of a client portfolio. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.