Despite elevated inflation and interest rates, unaffordable housing, social unrest, political polarization and ongoing wars, the mood of the market was decidedly positive as 2023 came to a close. U.S. investors, in particular, were celebrating a “Goldilocks” outlook of stronger growth, reduced inflation, lower bond yields and an expectation that the U.S. Federal Reserve would meaningfully lower administered interest rates in 2024.

Higher interest rates have taken an expected toll on the Canadian economy, with GDP contracting at an inflation-adjusted 1.1% annual rate in the third quarter. On the other hand, U.S. real GDP surprisingly accelerated at an annualized pace of 5.2% in the same quarter. The divergent growth is a function of a much bigger government deficit in the U.S. and a weaker consumer base in Canada. With greater debt relative to incomes and considerably more exposure to variable-rate mortgages, Canadians have suffered more from the increase in interest rates. Still, we think the lagged influence of higher interest rates will weaken the American economy in 2024.

While still elevated, inflation is coming down. In the U.S., the core annual inflation rate has receded from more than 5% to about 4%. In Canada, core inflation is 3.4%, down from a peak of 5.5%. The price of oil, which is not included in the core inflation calculation, recently dropped below US$70 per barrel from more than US$90 in September.

With inflation abating, the worst bond bear market since the 1970s came to an abrupt halt last October. In November, the Bloomberg U.S. Aggregate Bond Index registered a 4.5% gain, its best month since May 1985. The comparable Canadian bond benchmark advanced 4.3% in the same month, and bonds in both countries rallied further in December. By mid-December, the yield on the U.S. 10-year Treasury bond had fallen from a recent peak of almost 5.0% to about 3.9%, while the yield on the comparable Canadian bond had declined from 4.2% to roughly 3.1%.

Interest rates on shorter-duration T-bills are higher than long-term bond yields because the U.S. Federal Reserve and the Bank of Canada currently charge domestic banks a higher rate of interest to borrow from their respective central banks. The yield on T-bills and other short-term fixed income investments are tethered to those rates. Encouragingly, the futures market is discounting an expectation that the U.S. federal funds rate will decline from 5.5% to 4.25% by the end of 2024. With weaker growth in Canada, some forecasters believe the Bank of Canada will drop its rate even more, from 5.0% to 3.5%, over the same timeframe.

Lower bond yields and forecasts calling for lower administered short-term interest rates are tonic for stocks. Lower interest rates justify higher equity valuation multiples, especially if the economy holds up.

In Canadian dollar terms, the U.S. S&P 500 Index was up an impressive 23.4% for the year through mid-December, more than double the 9.3% gain in the S&P/TSX Composite Index, the Canadian equity benchmark. Over the same period, Canadian bonds returned 6.6%, while ultra-safe T-bills, which are a proxy for GICs and money market funds, generated 4.6%.

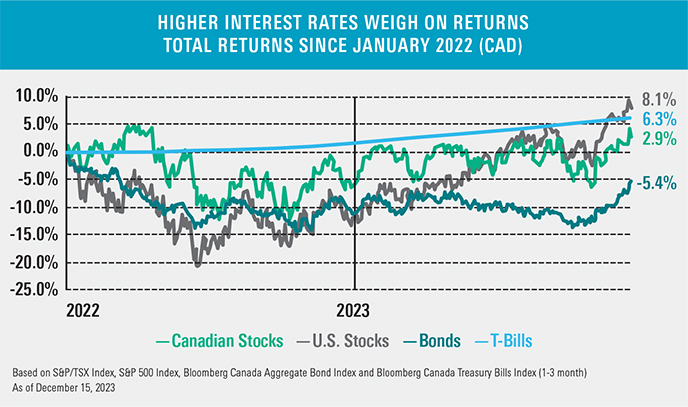

To get a more complete appreciation of the impact of higher interest rates, which started lifting off from ultra-low levels at the beginning of 2022, one needs to consider performance for both 2022 and 2023. Over that nearly two-year period, and as highlighted in the chart on page 2, bonds were the worst-performing asset class, down 5.4% and T-bills returned6.3%. Canadian stocks were ahead by just 2.9%, after spending much of the last two years in the red. U.S. stocks were down more than Canadian stocks for much of the period but recently rallied to an 8.1% gain, a little better than the return from T-bills. If it seems counterintuitive for bonds to perform poorly when interest rates are higher, consider this example that explains why. Imagine an investor bought a 10-year government bond last year that pays annual interest of 3%. Now imagine interest rates go up and new bond issues provide 5% interest. No investor would want to buy the bond with the lower 3% yield unless there was a discount in price. That is why bond prices go down when interest rates go up. If economic growth weakens and interest rates decline as expected, bonds should do better next year.

If it seems counterintuitive for bonds to perform poorly when interest rates are higher, consider this example that explains why. Imagine an investor bought a 10-year government bond last year that pays annual interest of 3%. Now imagine interest rates go up and new bond issues provide 5% interest. No investor would want to buy the bond with the lower 3% yield unless there was a discount in price. That is why bond prices go down when interest rates go up. If economic growth weakens and interest rates decline as expected, bonds should do better next year.

T-bills and other short-term fixed income investments don’t have the same interest-rate risk as bonds because their maturities are much shorter. A maturing one- or three-month T-bill can roll into a new T-bill with a higher coupon as interest rates rise.

Given the poor performance of bonds and the volatility and relatively uninspiring performance of stocks over the last two years, some investors wonder if they should allocate more money to T-bills or other safe short-term fixed income instruments. After all, such products currently yield 5% or better. Depending on their unique situation, we encourage clients to have ample short-term fixed income investments to meet their cash flow needs. However, there are risks to being over-concentrated in this space. First, if inflation abates and the economy slows, the interest rate on those securities will likely decline. Second, there is a good chance that inflation and taxes will erode the purchasing power of short-term fixed income investments over time. That is certainly what has happened historically and is probable in the future, too.

Of course, cash and near-cash instruments may prove to be the best investments if inflation and interest rates surprise on the upside or if we have a deep economic recession. While we don’t think either scenario is likely, both are possible.

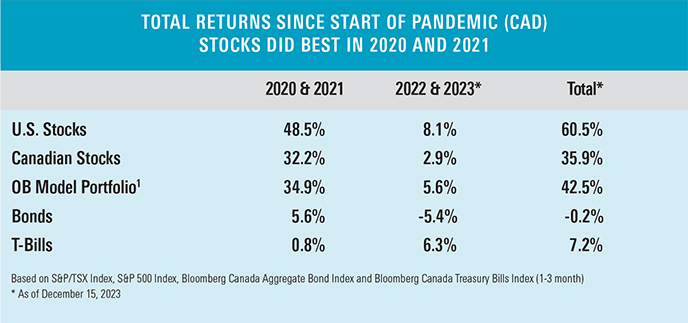

Over the long term, we still believe stocks will do better than bonds, and bonds will do better than T-bills. In fact, despite the pandemic and lackluster performance over the last two years, stocks have done much better than fixed income alternatives since the end of 2019. Over the nearly four-year period, U.S. and Canadian stocks have returned 60.5% and 35.9%, respectively, while T-bills have provided a total return of 7.2% and bonds have lost 0.2%. Investing in businesses with pricing power and growth opportunities will likely do the best job of preserving and growing wealth over time. Real estate can be effective in that regard, too, because rents tend to rise with inflation. But given that Canadian home prices are high relative to rents and incomes, stocks will likely do better.

Investing in businesses with pricing power and growth opportunities will likely do the best job of preserving and growing wealth over time. Real estate can be effective in that regard, too, because rents tend to rise with inflation. But given that Canadian home prices are high relative to rents and incomes, stocks will likely do better.

In the near term, stock market performance will be nuanced. Lower interest rates should have a positive influence on valuation multiples. But if interest rates go down because the economy is weak, corporate profits will deteriorate. That could be tough on some stocks, though not all.

What’s complicated is that stock prices are forward looking. Stocks always bottom before the trough in the economic cycle and rally before the economy rebounds. Some stocks are already discounting a difficult future, while others are not. General Motors’ stock, for example, is so beaten up it appears to be anticipating a brutal recession. The popular technology stocks, on the other hand, are discounting a much rosier outlook. As such, shares of cyclical businesses like General Motors might have less risk and more long-term potential than popular stocks that are near their highs.

The right mix of stocks, bonds and short-term fixed income investments is personal. It depends on each investor’s time horizon, specific needs and risk tolerance. The equity portion of a portfolio should be diversified and include both popular and unpopular stocks. The former may keep doing well in the near term, while the latter have the potential to outperform in the long run.

We wish you a healthy and happy 2024.

All performance figures are as of December 15, 2023.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.