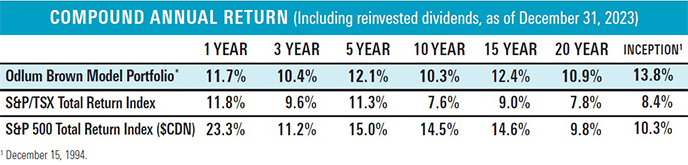

The Odlum Brown Model Portfolio* closed out 2023 and its 29th year with a gain of 11.7%. That was in line with the 11.8% advance in the Canadian equity benchmark, but less than half the 23.3% Canadian dollar gain in the U.S. S&P 500 Total Return Index.

The Odlum Brown Model Portfolio* closed out 2023 and its 29th year with a gain of 11.7%. That was in line with the 11.8% advance in the Canadian equity benchmark, but less than half the 23.3% Canadian dollar gain in the U.S. S&P 500 Total Return Index.

Over three, five and 10-year horizons, U.S. stocks have outperformed Canadian equities and our Model. For example, U.S. stocks have grown at a compound annual rate of 14.5% over the last 10 years, almost double the 7.6% annualized return from Canadian stocks and better than the 10.3% compound annual growth in our Model.

The superior performance of the U.S. market has been driven by a small group of very large businesses commonly referred to as the Magnificent Seven, which includes Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla. Their growth has outpaced other stocks by so much that the group now accounts for close to 30% of the market-capitalization-weighted S&P 500 Index.

In Canadian dollar terms, the Bloomberg Magnificent 7 Total Return Index more than doubled in 2023, with a gain of 102.1%. Without the Magnificent Seven, the so-called “S&P 493” would have been up an estimated 12.7% last year.1

While legitimate excitement regarding the profit potential from artificial intelligence was rocket fuel for the Magnificent Seven in 2023, most of the gains merely offset a huge 41.5% loss in 2022. After all, a 100% gain is needed to recover from a 50% loss. Nonetheless, the Magnificent Seven returned 18.2% in 2022 and 2023 combined. Over the two-year period, the S&P 493 gained 5.3%, while the Canadian S&P/TSX Total Return Index and our Model were up 5.4% and 6.6%, respectively.

Given the superior performance of U.S. stocks in general, and the Magnificent Seven in particular, some investors naturally wonder why they should own Canadian stocks or follow our Model, which is currently balanced 45% and 55% between U.S. and Canadian-listed securities, respectively.

Why not own a low-fee S&P 500 Index fund instead?

We don’t think the S&P 500 is an attractive index at this juncture. It is dominated by large growth stocks, which are considerably more expensive than they were a decade ago.

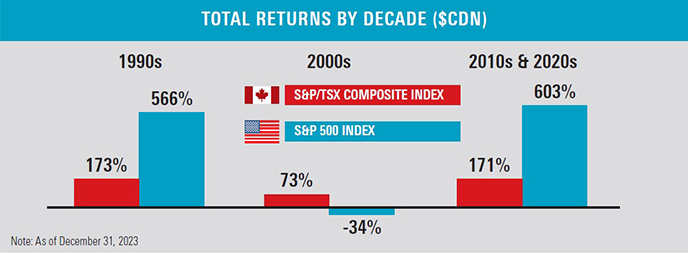

Over the last 60 years, there have been two lengthy periods when U.S. stocks failed to advance higher. The first was a 12.5-year period from November 1968 to April 1981 and the second was a 13-year stretch from March 2000 to March 2013. The one-two punches that undermined the market in the 1970s were excessive valuations going in and surging inflation. The market was held back in the 2000s once again because of excessive valuation and then by deflation fears after the Global Financial Crisis. In both periods, the market was dominated by very large companies, much like it is today. In the early 1970s, it was the Nifty Fifty (including Coca-Cola, IBM and Polaroid), and at the turn of the century it was technology stocks.  The enthusiasm Canadians have toward U.S. equities is reminiscent of investor attitudes in the late 1990s and early 2000s. At that time, and as is the case today, the rear-view track record meaningfully favoured U.S. stocks. The point is illustrated in the chart to the right. Note the symmetry between the 1990s on the left and the 2010s and 2020s on the right. U.S. stocks trounced Canadian stocks in both periods. Those who were enticed by the superior U.S. returns in the 1990s were very disappointed. U.S. stocks lost one-third of their value in the 2000s. The Canadian market didn’t do that well either because our technology darling, Nortel Networks, went bankrupt. It accounted for more than one-third of the Canadian market at the peak of the technology mania in 2000. We are not predicting that the S&P 500 will perform as poorly over the next 10 years, but we do think there is a good chance it will underperform relative to some of the better-priced alternatives.

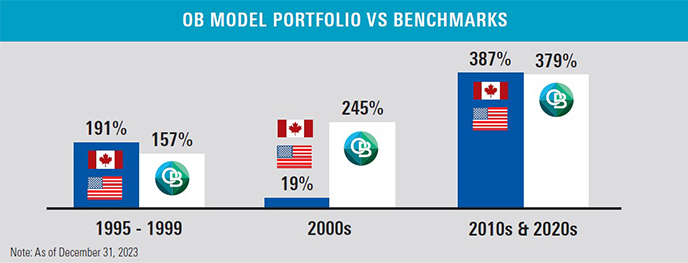

The enthusiasm Canadians have toward U.S. equities is reminiscent of investor attitudes in the late 1990s and early 2000s. At that time, and as is the case today, the rear-view track record meaningfully favoured U.S. stocks. The point is illustrated in the chart to the right. Note the symmetry between the 1990s on the left and the 2010s and 2020s on the right. U.S. stocks trounced Canadian stocks in both periods. Those who were enticed by the superior U.S. returns in the 1990s were very disappointed. U.S. stocks lost one-third of their value in the 2000s. The Canadian market didn’t do that well either because our technology darling, Nortel Networks, went bankrupt. It accounted for more than one-third of the Canadian market at the peak of the technology mania in 2000. We are not predicting that the S&P 500 will perform as poorly over the next 10 years, but we do think there is a good chance it will underperform relative to some of the better-priced alternatives.  A lot of stocks did well in the 2000s, despite the poor performance of the main equity benchmarks. Our Model prospered simply by avoiding or underweighting the popular and pricey stocks. Beneath the surface, there were many attractively priced stocks. Our Model appreciated 245% in the 2000s versus just 19% for a 50/50 blended benchmark of Canadian and U.S. stocks.

A lot of stocks did well in the 2000s, despite the poor performance of the main equity benchmarks. Our Model prospered simply by avoiding or underweighting the popular and pricey stocks. Beneath the surface, there were many attractively priced stocks. Our Model appreciated 245% in the 2000s versus just 19% for a 50/50 blended benchmark of Canadian and U.S. stocks.

Note the set-up for that market-beating performance. We didn’t keep pace with the blended benchmark in the second half of the 1990s (the Model was incepted in December 1994). Achieving good long-term returns requires patience, and sometimes that means underperforming in the short term. Being value-conscious, we have struggled to keep pace with the market in recent years. Since the end of 2009, and through to the end of 2023, our Model appreciated 379%, slightly less than the 387% gain in the blended benchmark.

We continue to own four of the Magnificent Seven – Apple, Amazon, Alphabet and Microsoft – and they are truly wonderful businesses. But their magnificence is well appreciated by investors and reflected in their premium valuation multiples. The forward price-to-earnings multiples for Apple and Microsoft, for example, are more than double what they were in 2013. We still like the Magnificent Seven businesses we own, but we don’t love them like we did when they were cheaper. Our combined exposure to the seven businesses is roughly 12%, less than half their representation in the S&P 500 Index.

While the opportunities to make a difference by being different are not as plentiful as they were at the turn of the century, we believe the odds are good that our Model will outperform the Canadian and U.S. equity benchmarks over the long run. That’s primarily because we believe the stocks in our portfolio have better risk and return characteristics than the growth stocks that currently dominate the S&P 500 Index.

1 We used the Bloomberg U.S. Large Cap ex Magnificent 7 Index as a proxy for the performance of what we call the “S&P 493,” which is the S&P 500 Index without the Magnificent Seven group of stocks.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

*The Odlum Brown Model Portfolio is an all-equity portfolio that was established by the Odlum Brown Equity Research Department on December 15, 1994, with a hypothetical investment of $250,000. It showcases how we believe individual security recommendations may be used within the context of a client portfolio. The Model also provides a basis with which to measure the quality of our advice and the effectiveness of our disciplined investment strategy. Trades are made using the closing price on the day a change is announced. Performance figures do not include any allowance for fees. Past performance is not indicative of future performance.

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.