In a recent tweet, Sebastian Siemiatkowski, CEO of buy-now-pay-later (BNPL) specialist Klarna, challenged the “old ways” saying, “We are coming for you… this decade will transform financial services.” While the message was playfully adorned with a smiley face emoji, some investors worry that there’s a deeper disruption brewing between new payment options and traditional credit cards. Is there really much to fear?

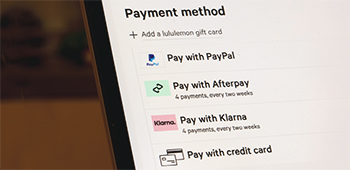

Klarna, which expanded into Canada last month, is a Swedish company that allows ecommerce merchants to offer installment plans to their customers. These plans generally consist of four equal payments without fees or interest, as long as all payments are made on time. BNPL companies generate revenue primarily by charging transaction fees to the merchant. Merchants are usually paid up front and in full, less the fee owing to their BNPL partner. Shoppers open an account on the BNPL platform, where they can see all their plan details and make their installment payments, typically from a debit card or direct bank transfer.

BNPL has surged in popularity, with the total number of users in the U.S. increasing by 300% per year since 2018.1 This is for good reason. Companies like Klarna allow online shoppers to more effectively bridge the cash-flow gap between spending and their paychecks, thus making their purchases more affordable. On the flip side, merchants benefit from fewer abandoned carts, larger average purchases and stronger customer loyalty. This all happens seamlessly on checkout pages, without the endless paperwork and confusing fine print that comes with traditional purchase financing.

Consequently, the largest BNPL companies have become a powerful force. Klarna achieved a private market valuation of US$45.6 billion in June. Another large BNPL specialist, Australia-based Afterpay, was acquired by Square (now known as Block) for US$29 billion in August. The largest American BNPL company, Affirm Holdings, ended 2021 with a market value of US$28 billion.

Meanwhile, credit card balances have come under pressure during the COVID-19 pandemic. At JP Morgan Chase, the leader among U.S. issuers, credit card loans have declined by 9% over the past two years. Naturally, a narrative has developed that BNPL is replacing credit cards, and many payments companies have seen their share prices come under pressure as a result.

The leaders of BNPL companies have no problem feeding this narrative. Affirm CEO Max Levchin has described credit cards as “a financial service equivalent of a Stone Age hammer: great power, zero elegance or safety.”2 As for Mr. Siemiatkowski, he describes himself in another tweet as “trying my best to be the nightmare of the bank establishment worldwide.” There’s nothing wrong with ambition.

We believe BNPL has legitimate appeal, and there is certainly much more growth ahead for these companies. However, some of the commentary surrounding BNPL, particularly when it comes to displacing credit cards, has gotten carried away.

When looking at the data, BNPL still only accounts for 2% of ecommerce volume worldwide, and this seems to have largely come from displacing debit transactions, rather than credit.3 Other data show that BNPL is driven by people with riskier credit profiles. For instance, in a recent study of 1,500 American users, nearly half of respondents said that “poor credit history and usually not being eligible for a credit card” was “one of the main reasons” for using BNPL. In the same study, over half of respondents admitted to using BNPL to spend beyond their means, and more than one third have missed at least one BNPL payment.4

Put another way, BNPL companies have been very successful at extending credit to people with more limited alternatives. Yet, when it comes to prying people away from their favourite credit cards, that’s a much bigger ask. Credit card users benefit from consolidating their spending in one bill while collecting enticing rewards. Perhaps most importantly, it is very difficult to change people’s habits.

As noted earlier, credit card balances have declined in the past two years, but this is due to COVID-19. Credit cards are used quite heavily for travel and entertainment spending, which experienced a falloff in purchase volume at the onset of the pandemic. Then government stimulus programs made it easier for people to pay down their balances. More recently, as the effects of stimulus have worn off, balances have begun to recover.

All the while, the BNPL industry has benefited from strong tailwinds that cannot last forever. Most notable is the benign credit environment; consumers are generally in healthy shape financially, and the BNPL industry has not yet been tested with widespread loan defaults. Also, the regulatory response has been practically nonexistent thus far, although that has started to change. As for the competitive response from banks and other established players, that has only just begun.

The Investment Opportunity

We’ve seen these types of stories emerge before – for instance, during the rise of PayPal over 20 years ago or the introduction of Apple Pay in 2014. Inevitably there is commentary that makes these contests sound like spectator sports; for every winner, there must be a loser, and if newer entrants achieve breakneck growth, it must mean existing players will suffer.

But this is not like Netflix versus Blockbuster, or Amazon versus Sears – it is very likely that more than one winner will emerge. This is exactly what happened with PayPal and Apple Pay, both of which have grown to be very powerful, but not at the expense of incumbents. We anticipate a similar outcome for BNPL.

In the meantime, we cover three companies in the payments industry, all of which have very profitable business models, high barriers to entry and numerous growth opportunities. Yet each one saw their share price decline in 2021, in part due to growing concern about BNPL. Thus we see an opportunity to own these stocks at very attractive prices, and we can still wish Mr. Siemiatkowski good luck with his audacious goal.

1 https://afterpay-corporate.yourcreative.com.au/wp-content/uploads/2021/10/Economic-Impact-of-BNPL-in-the-US-vF.pdf

2 S&P Capital IQ transcript of Affirm investor presentation, September 2021

3 https://www.bloomberg.com/news/articles/2022-01-13/buy-now-pay-later-the-credit-card-alternative-to-put-a-twist-on-consumer-debt

4 Buy Now, Pay Later is surging but consumers overextend their credit | Breeze (meetbreeze.com)

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research here.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information's accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of some of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member-Canadian Investor Protection Fund.