What’s on the Horizon in Health Care?

Wednesday, July 05, 2023

Health care is an ever-evolving industry. Consider the momentous changes witnessed over the ages and the progress achieved through research and development. Whether it be in pharmaceuticals, techniques and procedures, new tools and equipment; the history of medicine is rife with spectacular discoveries. So, what’s next?

Biologics and Bioprocessing

Cell-based pharmaceuticals, including certain flu vaccines, have been around for a long time. More recently, a new class of drugs has emerged – biologic therapeutics. Biologics are genetically engineered living cells used to produce helpful enzymes, organic acids, antibiotics, vaccines and proteins. The most notable biologics are monoclonal antibody therapies, or MABs, which have progressed meaningfully since they were developed in the mid-1980s. Other examples include cell and gene therapies that target disorders and infections like rheumatoid arthritis, chronic migraines and anemia.

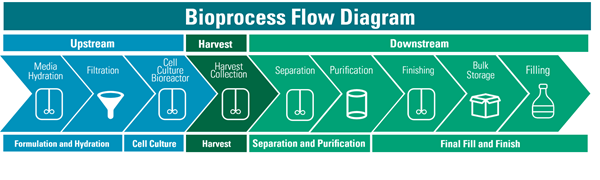

Bioprocessing is the procedure through which living cells become biologics. It includes the research, development and manufacturing of biologic treatments. Manufacturing begins with a cell culture (i.e., growing cells in a lab.) The cells are cultivated, refined, harvested and densified for large-scale production. Bioprocessing also involves various stages of filtering and clarification.

Similar to oil and gas, bioprocessing is divided into two manufacturing categories: (1) “upstreaming,” when cells are grown to achieve a targeted solution; and (2) “downstreaming,” when the desired biological product is completed through a series of steps, including separation, purification and product packaging. Bioprocessing requires equipment, like bioreactors and mixers, and consumables, such as chromatography resins and filters, which make up the majority of industry sales.

For more information on bioprocessing visit ScienceDirect.com.

For more information on bioprocessing visit ScienceDirect.com.

What Makes Bioprocessing an Attractive Investment?

Producing biologics is a heavily regulated process. As part of the approval process, biologic manufacturers must disclose broad-based descriptions of the product, including the production process, testing and controls. In other words, it’s not just the products that receive approval but also the manufacturing process used to develop the therapies. Once a biologic is approved, manufacturers typically avoid making changes, as doing so would require new approval and certification. From our perspective, that makes bioprocessing equipment and consumables consistent and reliable investments.

According to Precedence Research, the global biologics market is expected grow roughly 8% from 2022 to 2030 to $720 billion. The success of biologics, and MABs in particular, is driving demand for bioprocessing equipment and consumables, which is also forecasted to achieve above-average growth of around 8-9% per year.

Today, 60% of all drugs in development are in biologics compared to roughly 20% just 20 years ago. The research and development pipeline for biologics is strong – there are more than 20,000 biologics in development, while cell and gene therapy developments are 10X higher since 2015.

We gravitate toward high-quality companies with dominant market share in relatively concentrated industries. To learn more about our specific recommendations in this space, speak to your Odlum Brown Advisor or Portfolio Manager.

Please read our Odlum Brown Limited Disclaimer and Disclosure - It is important!

Odlum Brown Limited is an independent, full-service investment firm focused on providing professional investment advice and objective research. We respect your right to be informed of relationships with the issuers or strategies referred to in this report which might reasonably be expected to indicate potential conflicts of interest with respect to the securities or any investment strategies discussed or recommended in this report. We do not act as a market maker in any securities and do not provide investment banking or advisory services to, or hold positions in, the issuers covered by our research. Analysts and their associates may, from time to time, hold securities of issuers discussed or recommended in this report because they personally have the conviction to follow their own research, but we have implemented internal policies that impose restrictions on when and how an Analyst may buy or sell securities they cover and any such interest will be disclosed in our report in accordance with regulatory policy. Our Analysts receive no direct compensation based on revenue from investment banking services. We describe our research policies in greater detail, including a description of our rating system and how we disseminate our research, on the Odlum Brown Limited website at www.odlumbrown.com.

This report has been prepared by Odlum Brown Limited and is intended only for persons resident and located in all the provinces and territories of Canada, where Odlum Brown Limited's services and products may lawfully be offered for sale, and therein only to clients of Odlum Brown Limited. This report is not intended for distribution to, or use by, any person or entity in any jurisdiction or country including the United States, where such distribution or use would be contrary to law or regulation or which would subject Odlum Brown Limited to any registration requirement within such jurisdiction or country. As no regard has been made as to the specific investment objectives, financial situation, and other particular circumstances of any person who may receive this report, clients should seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies discussed or recommended in this report.

This report is for information purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. The information contained in this report has been compiled from sources we believe to be reliable, however, we make no guarantee, representation or warranty, expressed or implied, as to such information’s accuracy or completeness. All opinions and estimates contained in this report, whether or not our own, are based on assumptions we believe to be reasonable as of the date of the report and are subject to change without notice.

Please note that, as at the date of this report, the Research Analyst responsible for the recommendations herein, associates of such Analyst and/or other individuals directly involved in the preparation of this report hold securities of the issuer(s) referred to directly or through derivatives.

No part of this publication may be reproduced without the express written consent of Odlum Brown Limited. Odlum Brown Limited is a Member of the Canadian Investor Protection Fund.